This is the second part of the answer to the question: “What are the rules within Bitcoin?” How does robust consensus and decentralized decision-making affect the predictability of the system? How does this compare to certainty and predictability within traditional financial institutions, such as interest rate changes? I can’t predict what the U.S. interest rates will be next year, but I can predict what the rate of distribution (block reward) of bitcoin will be in 100 years.

Minutes from Federal Reserve meeting: https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf

Watch Part 1 here: https://youtu.be/VnQu4uylfOs

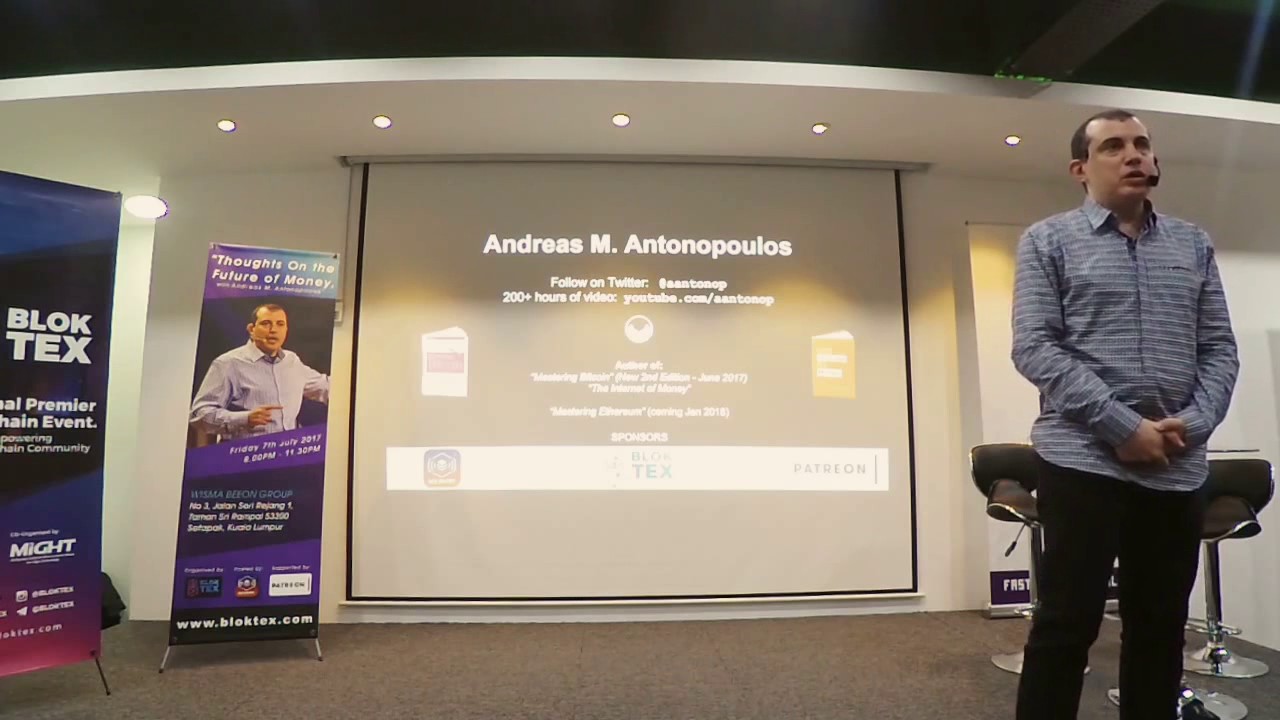

This is part of a talk which took place on July 7th 2017 at a Bloktex event hosted by the Wisma BeeOn Group in Kuala Lumpur, Malaysia: https://antonopoulos.com/event/the-future-of-money-kuala-lumpur-malaysia/

Watch the full talk here: https://youtu.be/HaJ1hvon0E0

RELATED:

Bitcoin: Where the Laws of Mathematics Prevail – https://youtu.be/HaJ1hvon0E0

Forkology: A Study of Forks for Newbies – https://youtu.be/rpeceXY1QBM

SegWit, scaling, and consensus – https://youtu.be/Jc7mrR6AAto

Fee market, SegWit, and scaling – https://youtu.be/zxt-FLzZPhg

Scaling is a moving target – https://youtu.be/pT9kJq_Ogrk

The scaling rites of passage – https://youtu.be/rZi86_ovB3Y

What is the biggest threat? – https://youtu.be/1-XUbH1F0Os

Is Bitcoin a democracy? – https://youtu.be/TC3Hq76UT5g

Governance trade-offs in decentralised systems – https://youtu.be/dtwaW79Fj7c

Bitcoin & Blockchain in Norway – https://youtu.be/5ODDCx6VL2Y

The end of vampire-squid financing – https://youtu.be/yyXOQG5iNWo

Rules vs. Rulers – https://youtu.be/9EEluhC9SxE

The Currency Wars and Bitcoin’s Neutrality – https://youtu.be/Bu5Mtvy97-4

The Killer App: Engineering the Properties of Money – https://youtu.be/MxIrc1rxhyI

Andreas M. Antonopoulos is a technologist and serial entrepreneur who has become one of the most well-known and well-respected figures in bitcoin.

Follow on Twitter: @aantonop https://twitter.com/aantonop

Website: https://antonopoulos.com/

He is the author of two books: “Mastering Bitcoin,” published by O’Reilly Media and considered the best technical guide to bitcoin; “The Internet of Money,” a book about why bitcoin matters.

THE INTERNET OF MONEY, v1: https://www.amazon.co.uk/Internet-Money-collection-Andreas-Antonopoulos/dp/1537000454/ref=asap_bc?ie=UTF8

MASTERING BITCOIN: https://www.amazon.co.uk/Mastering-Bitcoin-Unlocking-Digital-Cryptocurrencies/dp/1449374042

[NEW] MASTERING BITCOIN, 2nd Edition: https://www.amazon.com/Mastering-Bitcoin-Programming-Open-Blockchain/dp/1491954388

Subscribe to the channel to learn more about Bitcoin & open blockchains!

If you want early-access to talks and a chance to participate in a monthly LIVE Q&A with Andreas, become a patron: https://www.patreon.com/aantonop

Music: “Unbounded” by Orfan (https://www.facebook.com/Orfan/)

Outro Graphics: Phneep (http://www.phneep.com/)

Outro Art: Rock Barcellos (http://www.rockincomics.com.br/)

source

The number 1 rule in Bitcoin? You don't talk about Bitcoin

I always learn a lot from you and look forward to more educational videos..thanks!

thanks 🙂

There's actually less coins in circulation..I'm not sure exactly but many coins that were mined early have been lost due to damaged hard drives or lost keys etc..could be several % pts!

some people wonder why bitcoin has certain rules, and not other ones. they have come up by convention and educated guesses on these rules. the much overlooked aspect of it is that we have rules that we can rely on, not which rules they are. this and the fact bitcoin was the first to set up an almost arbitrary set of rules that anyone can rely on not ever being changed, is invaluable and one of the main reasons for bitcoin's value. many don't understand this. and many in the legacy system waste energy on discussing what rules are the right ones. all global judicial systems are basically relying on people fighting over changeable rules. this is super inefficient.

Keep teaching, we will keep learning and sharing and growing this space! I blog a lot of your stuff out regularly on Steemit!

So does that mean there will be 21 million Bitcoin cash coins or bch?

Andreas is a mathematical genius, with the ability to communicate his genius to others! I trust Bitcoin and cryptos because I trust this guy and those like him!

bitcoin is not a currency any more, it's a secure and mathematical reserve of value.

He means inflation, not interest rate.

☝☝☝☝☝☝

Genesis Comment