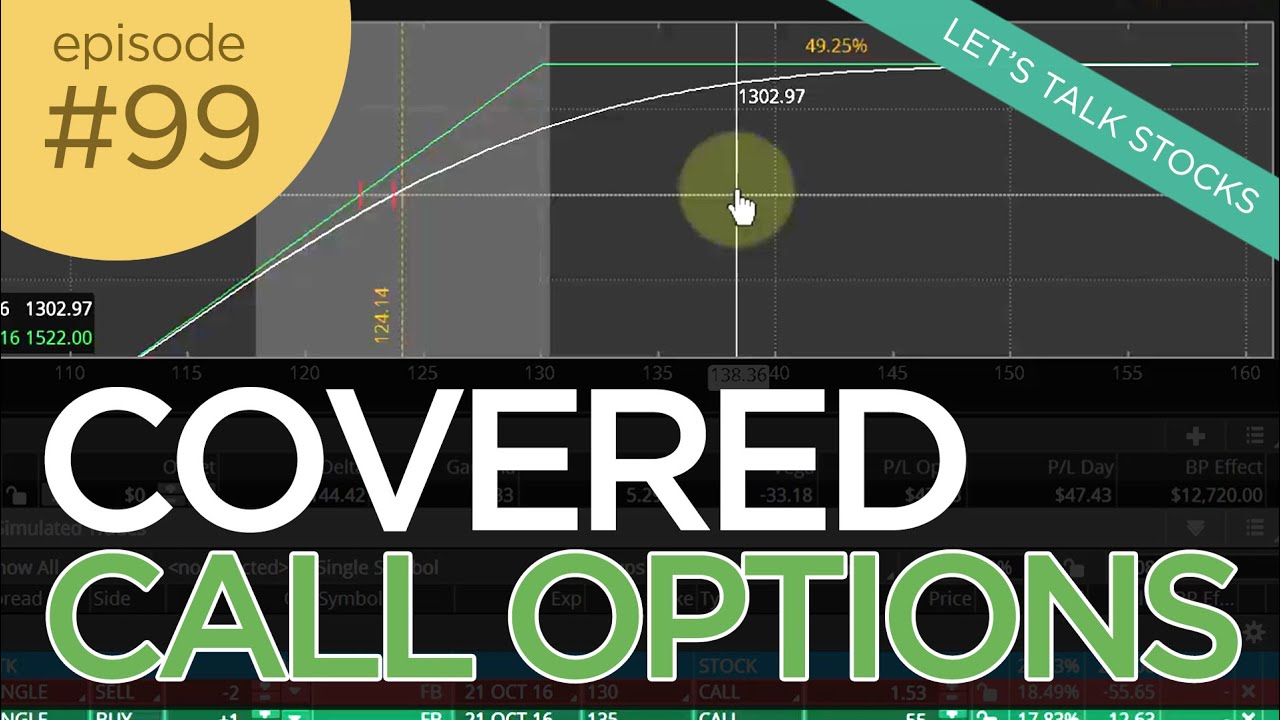

Ep 99: Trading Covered Call Options with Stocks You Own

★ SUMMARY ★

Episode number 99 is all about trading covered call options with stocks you own. In today’s video I don’t have my green screen set up because I’ve decided to rearrange a few things in the office and make things a little bit better. So things are in a changing dynamic mode, so maybe within a couple of weeks I’ll get everything set up and we’ll go back to doing some things with the webcam.

In this episode we really want to take some things on screen and look at some options, if you’re not advanced with options, don’t worry, this is a fairly basic options training video.

I’m going to share with you how to reduce that risk as we go through this process, but it gives you a little bit of an edge to making a little more money as things are just standing still or if things pull back a little bit, you can collect some premium, so you will need to have option capabilities and depending on which broker you use, you’ll probably need to be able to sell options and sell those option premiums within your trading panel, so contact your broker if you don’t know what that is and we’ll go through the lesson and you’ll see exactly what I’m talking about and you can describe that to your broker and get more insight.

Posted at: http://tradersfly.com/2016/08/ep-99-trading-covered-call-options-stocks/

★ SHARE THIS VIDEO ★

★ SUBSCRIBE TO MY YOUTUBE: ★

http://bit.ly/addtradersfly

★ ABOUT TRADERSFLY ★

TradersFly is a place where I enjoy sharing my knowledge and experience about the stock market, trading, and investing.

Stock trading can be a brutal industry especially if you are new. Watch my free educational training videos to avoid making large mistakes and to just continue to get better.

Stock trading and investing is a long journey – it doesn’t happen overnight. If you are interested to share some insight or contribute to the community we’d love to have you subscribe and join us!

FREE 15 DAY TRIAL TO THE CRITICAL CHARTS

— http://bit.ly/charts15

GET THE NEWSLETTER

— http://bit.ly/stocknewsletter

STOCK TRADING COURSES:

— http://tradersfly.com/courses/

STOCK TRADING BOOKS:

— http://tradersfly.com/books/

WEBSITES:

— http://rise2learn.com

— http://criticalcharts.com

— http://investinghelpdesk.com

— http://tradersfly.com

— http://backstageincome.com

— http://sashaevdakov.com

SOCIAL MEDIA:

— http://twitter.com/criticalcharts/

— http://facebook.com/criticalcharts/

MY YOUTUBE CHANNELS:

— TradersFly: http://bit.ly/tradersfly

— BackstageIncome: http://bit.ly/backstageincome

source

how can I avoid getting my shares called away…..what do you do if the stock drops 10$ so from 60 to 50, do you sell covered calls at 52 strike price even though you bought the shares at 60?

So lets say you own 100 shares of a stock that is currently trading at $50 and you want to sell a covered call but the problem is that you paid $52 for it so you would pick a strike price a little above what you paid for it , such as $53 . Is that right ???

Very good video for beginners. So if you sell covered calls you cannot lose money. I know the price of the stock you are holding can go down but if you do this strategy with large cap dividend paying stocks that you don`t mind holding long term how can you lose ?????

What happens if you select a strike price that is less than the current price?

This should have been explained better…… in a shorter time.

Basically you own stock and you want to keep them. You sell an option to try to collect a premium without selling your stocks Sell an option at a higher price that you don't think the stock will reach. And you keep the premium.

Sasha… one more question… how would you trade the covered call with long calls instead of shares? I believe it's poor man's covered call…. could you also make a video on that on give a brief explanation? Thanks!

Hi Sasha, thanks for all your videos. Is there any advantage to buy call contracts in case the stock goes above the strike I sold the contracts so I can keep the shares or it doesn't matter profit wise? Thanks!

Could you also close out your calls early buy buying them back when its getting closer to your strike? I would rather do this but like to keep my shares so I would sell the contracts if there was a chance they we're getting in the money.

So when the stock is going against you and you are loosing money trade the stock asap Im assuming

wow i reallly love your videos i learned so much from you youre a very good teacher! only thing is that options trading is there to give you more options and it is not free money as you tend to tell in your video the risk/reward is always in line and it is always zero sum.The fact is that it helps very much with risk management and money management. even if you have 1% of losing, you will eventually see that 1% come into play because you dont only trade once and when this 1% comes in it catches up for the 99% times you win! its just the concept let alone the trading skills. other than that i watch and recommend all your videos and keep up the good work and thanks for keeping it true and real!!

Oh. My God. You packed 4 minutes of information into a 43 minute video. And I watched it all. Could you explain ONE MORE TIME what happens when the stock price moves up to 135? I didn't catch the first eight times you went through it. Time to unsubscribe.

Can't wait for your options course to come out. I know that it is going to be good.

I tried this in January with 200 shares of AT&T April 15 $37 calls. For a stock that channeled for the last seven years-never rising above $37, this seemed like a good bet. The advice in books, from my broker and online suggested a minimum three month hold to catch a decent profit, but when the deal went through I was only offered $60.

I much prefer your suggestion of a month.

The stock bolted up over those three months to $39.36 and while not immediately called away, the stock was assigned. My question to you, is it possible to cancel a cover call option contract if you feel things are not working out in your favor or are you committed until the expiration date? I could not get a straight answer from my broker.

if you sell 1 covered call for a stock that you own less than 100 shares of, do you stand to loose more?