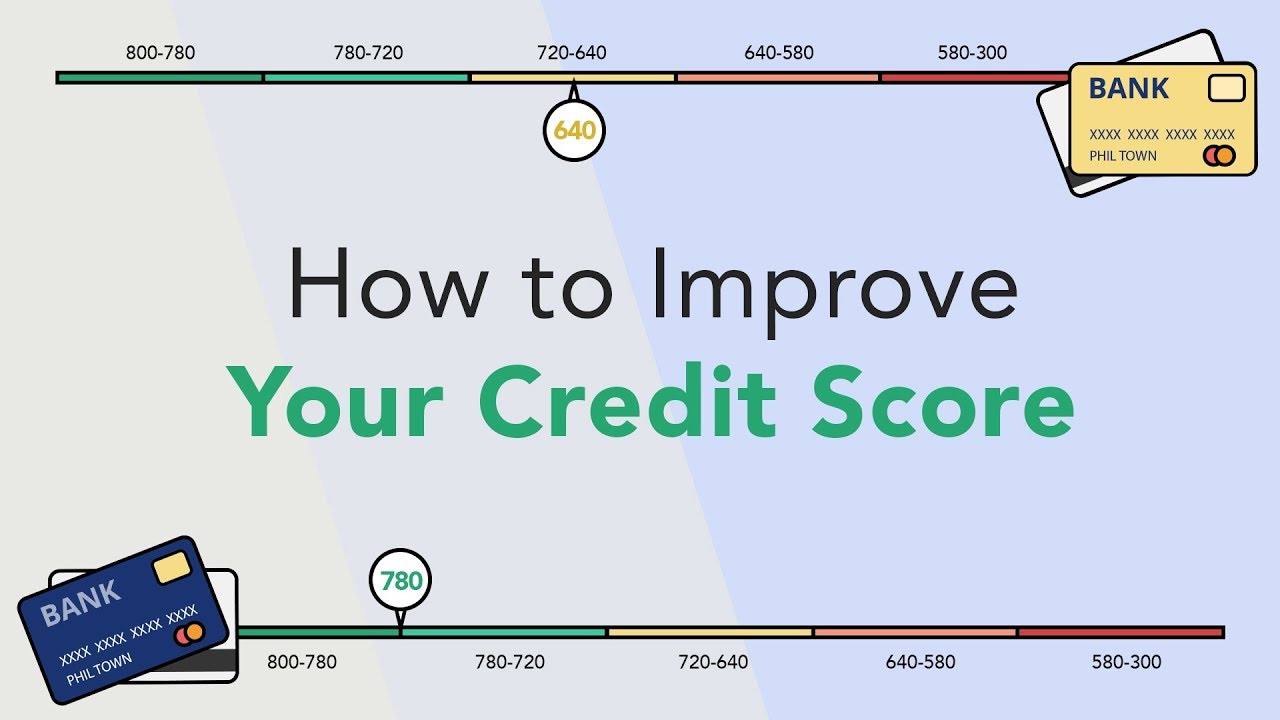

It’s no secret that your credit score can have a major impact on your ability to get approved for financing—but did you know that your credit score can even affect your ability to rent an apartment or secure certain jobs? http://bit.ly/2zrDXLA

In this video I’ll give you 5 tips to improving your credit score which will, in turn, benefit your investing practice as well.

Are you struggling with credit card debt? Download my FREE get out of debt checklist by clicking the link above!

Looking to master investing? Attend one of my FREE 3-Day Transformational Investing Workshops. Apply here http://bit.ly/r1workshop

_

Learn more:

Subscribe to my channel for free stuff, tips and more!

YouTube: http://budurl.com/kacp

Facebook: https://www.facebook.com/rule1investing

Twitter: https://twitter.com/Rule1_Investing

Google+: + PhilTownRule1Investing

Pinterest: http://www.pinterest.com/rule1investing

LinkedIn: https://www.linkedin.com/company/rule-1-investing

Blog: http://bit.ly/1YdqVXI

Podcast: http://bit.ly/1KYuWb4

credit score, credit report, credit repair, credit cards, free credit score, money tips, financial advice, how to improve credit,

source

Thanks for watching my video, folks! What other ideas do you have to help improve your credit? What helped you improve your credit?

Are you struggling with credit card debt? Download my FREE get out of debt checklist >> http://bit.ly/2zrDXLA

Get your credit scores fixed and boosted in less than 3weeks, contact tophacker247 @gmailcom

Is it a good idea to use a credit card to buy stocks in order to invest and build credit at the same time.

My recommendation to you guys if you're trying to get most points each and every month to your credit score, always use the 1% to 3% regardless of your credit limit thank you.

looking forward to taking your class in Peachtree City, GA next month!

933

* I set up an auto-payment (for the minimum due) as a back-up just in case I don't make a payment by the due date. This way, I'll never be late with my payment.

* I get daily alerts so I always know the balance and activity.

* Each week when I get paid, I transfer a payment to my credit card to pay off all the transactions I made that week.

* I charge everything on my card to earn points.

So far, all these little steps combined have worked well for me.

Thanks for your helpful video! ?

Let me recommend supreme technology to you guys, this guy is extra ordinary good fixing credit score, pay off mortgage, student loan, equity line of credit and so on. this guy raise my credit score from 520 to 830 in just 5 business days and deleted all unwanted collections on my reports, it stays permanent since over 8 months. incase you need his service, reach him through supremetechnologies007@gmail.com Best of luck……

I have two credit cards with high limits. One of the credit cards always offers 0% interest on balance transfers at the beginning of the year. There is no fee on either card for balance transfers. The other card I keep as low as possible. When the promo comes along, I will transfer the entire balance to the one with the available credit. This other card also gives me 1% back on balance transfers (winning). Then I transfer all that money back within the grace period to the other card to take advantage of the 0% again for another 12 months. So, I keep my apr at 0% ongoing and I get 1% back in the process. Both are with credit unions. I've done this for years now.

Thank you so much for making theses videos, I'm glad I discovered them at 21.

So far I increased my IRA contributions and switched from pretax to roth, doubled down on my college debt, stopped looking at new cars and kept myself on a better budget. Thanks for the great advice!

I am 18 years old, I can save up to 800$ each month, and I want to start investing. How should I do it?(I did not even choose a broker)…

Hi Phil! Love your videos and your book, thanks for all the informations you are sharing with us.

I would have two questions I’d like to ask you:

-What do you think about cfd?

-If the price of a certain stock is cheaper than our mos and all the tools are well into the “buy zone” do we have to wait for the three tools to say sell and wait for the next buy signal or we can just buy straight away?

Thanks and have a great day!

There are 5 rules to life…

1. Don't smoke.

2. Don't drink and drive

3. Always wear your seatbelt.

4. Don't sleep around.

5. Pay your credit card bill on time and in the full amount.

Bonus rule 6. Go to church.

Bonus rule 7. Exercise.

You can play around with the order of importance, but these are pretty much right. If you do those things you'll avoid a lot of the big tragedies in life. You'll get to see your kids graduate, your marriage is less likely to end in divorce and you'll probably fight a lot less along the way. You'll also need your doctor a lot less!

I keep hearing we are due for a recession and stocks/cash/estate wont have much value. Can you make a video about mitigating against the recession? I hear about investing in things like crypto or gold.

Hello, I am 18 and have been trying to save as much as I can for the last 2 years. It has just been getting hard lately due to the fact that i never wanna go out because I don’t wanna spend that $. I just found your channel recently and have motivated me a lot to keep going so thank you. Also I have 2 questions being 18, what stock (me being in canada) would be the best to throw $50 into for the rest of my life that would get a steady rate in return for the next 50 years? Also can you do a video on how to budget on hobbies or things you do on the side like what % of income should you be spending on fun stuff. So you don’t drive your self crazy working 7 days a week 65 plus hours at Canadian minimum wage and can do something for fun.

Does increasing credit limit on credit card helps? My bank offered limit increase but I refused, someone told me that I should have accepted it.

Nice channel

How does it cost for rule 1 book ?

do you know beau craibill?

Simple, don’t use credit card at all. Lol.

Funny, I bought one of those little books about improving your credit score for kindle for a couple of bucks, and this video is way better! Thanks Phil, these videos are awesome.

Regarding 3:30, I use my AMEX line credit almost entirely per month, am I affecting my credit score even I always pay on time?

Setting up automatic payments has really helped.

Paid off my mortgage, no credit cards or other installment plans except an auto loan. Auto loan is mainly for maintaining a credit score. Good luck to everyone!

I paid off my car and credit card a few months ago and my score dropped. Something about available credit decreases.

statsu polish freind had some good ideas

Love your new thumbnails. So much better 🙂