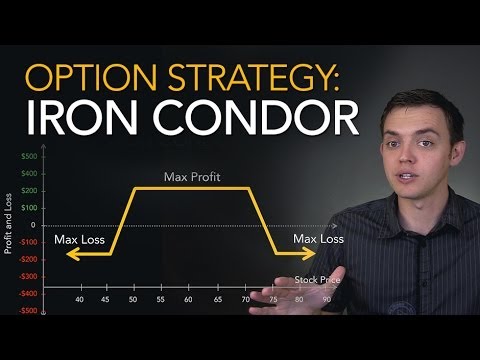

Trading Options: How to Setup an Iron Condor

Continue to learn with me at: http://tradersfly.com/

Check out my courses at : http://rise2learn.com

Facebook Fan Page: http://www.facebook.com/tradersfly/

Get My Charts on Twitter: https://twitter.com/tradersfly/

source

Best and Knowldegeble vdo

Makes sense, but I am always making 60 and risking 440 with spy and dia

Thanks.

if you trade stocks, how can you go forward without learning something called an "Iron Condor"? Just sounds cool. I made 5k off my Iron-Condor last month!

Can you put a Stop loss/ order on an Iron-Condor? I would assume so.

nice! i wonder to know your trading system plataform.

Great video Sasha,

Which trading platform is he using?

Sasha when you showed the diagram of the call option graph, you said it was a call spread. However shouldn’t a call spread have a max profit level? Not infinite profit? Maybe just mis stayed the name?

I dont get it! What is the point of taking long contract 40-30 days?!!? Why not execute the selling of iron condor in a short contract with 5 to 2 days till exparation???? Please, explan!

Great video and explanation of how to place/set an Iron Condor and being Theta positive is a plus.

Hi,

can you please explain the weirdor iron condor?

Thanks

Nobody ever say what happens when your iron condor expires in a loss.

hi 1 query i have , after implementation condor ,

and any one side is in pressure,

what adjust should have done for avoid loss,

or off the position with loss

The majority of 2014 was a good year to be doing iron condors on AMZN.

BTW the color choices of the red lines on blue background risk graph on TOS are difficult to discern. Does the TOS platform have custom color configs?

Novice questions – This video is explained so well, but something doesn't add up for me. If you "confirmed and sent" the trade, how much would it have cost? Do you have to accumulate more theta premium than the cost of the condor in order to profit from it? How long would it take for you to break even if the stock didn't move? Sorry I'm so confused.

Hey sasha, excellent work you been doing!

I have to ask you something, how far of the expiration date, how wide the spreads would you recommend?

Thanks

Are you actually buying stock, or is this buying and selling options premiums? I would hate to sell stock I dont have.

I'm confused, you collect theta premium every day?!?

Great video!! Too much to digest as a beginner lol.

do you get paid credit every day? all at once? at expiry? on day 1? or when you buy the iron condor back?

Thank you Sasha for the video. Very helpful. What Platform did you used to setup the Option in this example?

if i sell a iron condor and only try to make between 100 and 200, how do i get out before expiration date? or can i?

Excellent! I am very interested in trying this strategy.

hello just wanted to know which trading platform you use?

Nice video. What are you using to show those slick profit and loss charts?

I have question regarding all these strategies. Do you need to actually own the stock to set these up or can they be done naked?

You are owe some Sacha ,thanks for the vid

Holy crap I feel like a dummy trying to wrap my head around options trading. Screw it! I'll stick to playing blackjack.

amazing video!

You touch yourself a lot, I can tell.

Great video, going to be watching more! Thanks!

COOL i'm starting to see it thanks 🙂

Very informative. Thanks!

Sasha, you're a great teacher!! Thanks for the lucid presentation of condors.

This is a really interesting video, however it was confusing for a beginner like myself. Main confusion lies in the fact that 2 debit spreads are presented in the beginning, however, the iron condor is created using two credit spreads, on the opposite sides of the stock price… in fact you present a bullish put spread and a bearish call spread in the selling of the iron condor… not sure why this had to be presented in such a complicated manner, but all in all – ok video.