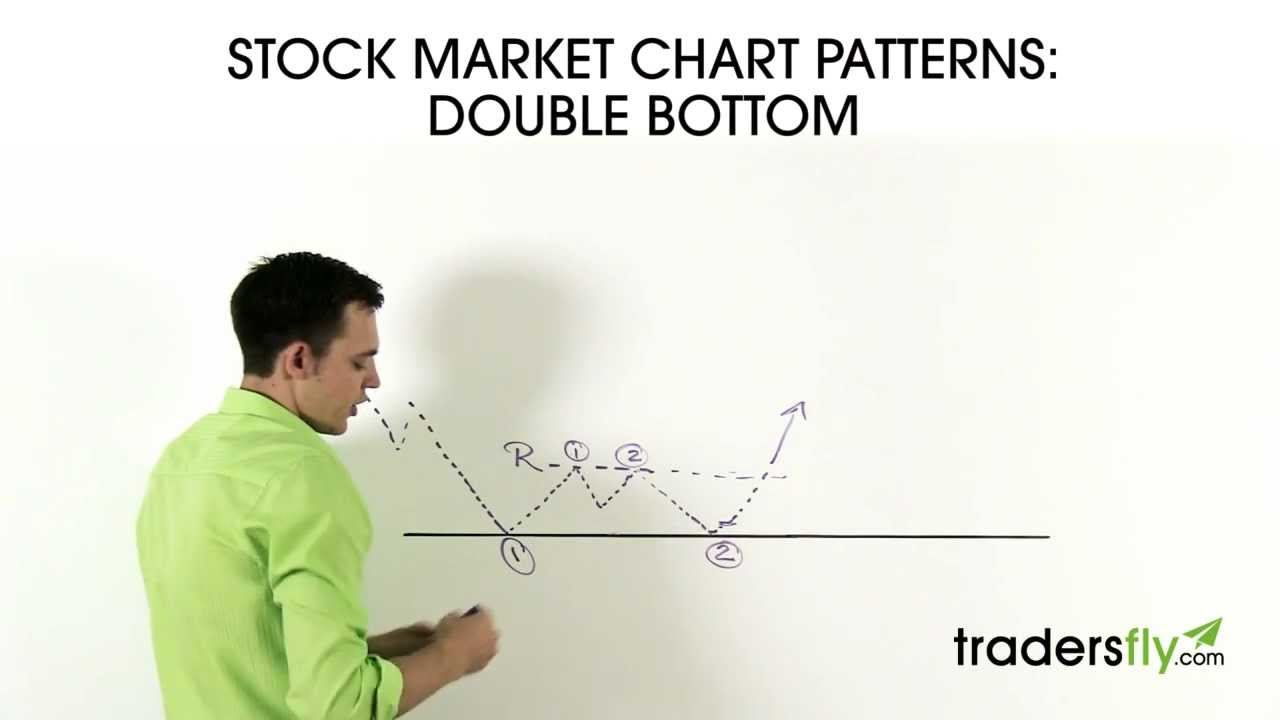

The double bottom reversal pattern is similar to the double top reversal pattern, but it goes in the opposite direction.

What Is the Double Bottom Reversal Pattern?

-It’s a reversal pattern or bullish pattern

-Begins with a downward pattern and typically ends with an upward pattern

-There can be double tops or triple tops between the double bottom

-Double bottoms take longer to develop than double tops

-Even if there is a double top between the double bottom, it is more important that there is a double bottom because it spans a longer period of time than the double top

How to Trade a Double Bottom Reversal Pattern

-Enter the stock somewhere off the second bottom

-Ideally, you should enter it after it crosses the resistance line (from the two tops that occurred earlier)

★ SUBSCRIBE TO MY YOUTUBE: ★

http://bit.ly/addtradersfly

★ ABOUT TRADERSFLY ★

TradersFly is a place where I enjoy sharing my knowledge and experience about the stock market, trading, and investing.

Stock trading can be a brutal industry especially if you are new. Watch my free educational training videos to avoid making large mistakes and to just continue to get better.

Stock trading and investing is a long journey – it doesn’t happen overnight. If you are interested to share some insight or contribute to the community we’d love to have you subscribe and join us!

STOCK TRADING COURSES:

— http://tradersfly.com/courses/

STOCK TRADING BOOKS:

— http://tradersfly.com/books/

WEBSITES:

— http://rise2learn.com

— http://criticalcharts.com

— http://investinghelpdesk.com

— http://tradersfly.com

— http://backstageincome.com

— http://sashaevdakov.com

SOCIAL MEDIA:

— http://twitter.com/criticalcharts/

— http://facebook.com/criticalcharts/

MY YOUTUBE CHANNELS:

— TradersFly: http://bit.ly/tradersfly

— BackstageIncome: http://bit.ly/backstageincome

source

What if it penetrates the support of the double bottom?

yes yes me

which type of charts do these technical analysis methods apply to? daily, weekly, monthly, yearly, etc.

Wow it's really unbelievable how accurate this is. I just did my very first two trades with Yamana gold (AUY), purchasing some shares and then some options contracts. Right at this moment im watching your video, and looking at the stock chart on finviz. The chart is covering the last 9 months to a year roughly. You are so right! It hit the first bottom in mid September at 1.50, and just hit the second one in mid January at 1.50 again. Two tops formed during a much shorter time period one in late August and the second in mid to late october. The stock just broke through resistance at 2.50, and has been moving upwards since. If what you are saying holds through, I might have gotten in at just the right time. very informative videos on your channel, will be subscribing.

the problem with these patterns is that u realize after they don't predict anything so what's the point in knowing them?

Do double bottoms usually form double tops? Or could it be a single top?

How about if it hits more than two tops before the last bottom? Or what if after the first top it hits the bottom then hit the second top, followed by another bottom? Or it didn't hit the bottom after that. Does it still apply? Thanks!

Should I also be looking for big positive volume once it breaks trough the resistance for confirmation?

Great video's btw.