If you want to purchase shares right away, you are going to have to pay the asking price. Similarly, if you want to sell shares right away, you have to pay the bidding price.

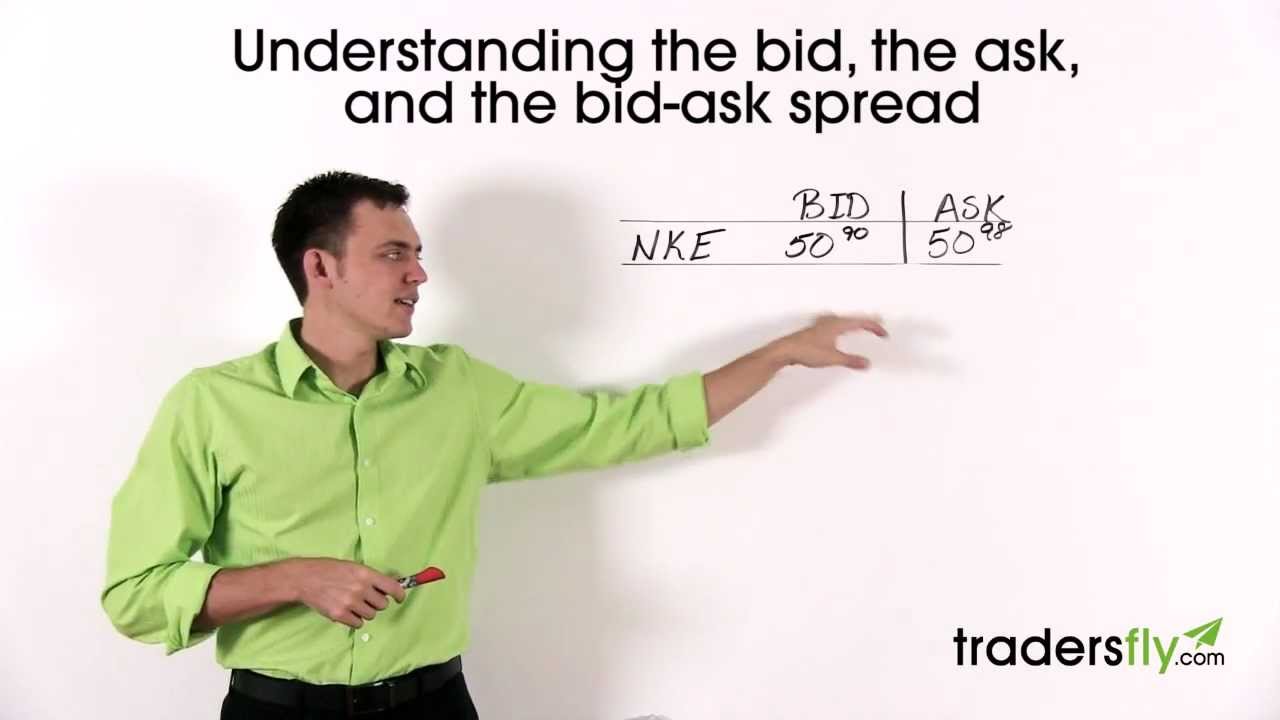

Bid:

-What people are looking to get the order at

-If you want to purchase 100 shares of Nike, you might bid $50.90, but the ask is $50.98

-In order to get that order, you need to pay $50.98

Ask

-What people are looking to get for the stock

Bid-Ask Spread

-It is the difference between the bid and the ask

-What the market makers have to make

-i.e. $50.98-$50.90 = $0.08

-$0.08 is what the market makers get paid to execute that order

-As soon as you purchase the stock you lose $0.08 per share

-You can’t buy and sell immediately because it will be costly

-You need to take the bid-ask spread into account when trading

★ SUBSCRIBE TO MY YOUTUBE: ★

http://bit.ly/addtradersfly

★ ABOUT TRADERSFLY ★

TradersFly is a place where I enjoy sharing my knowledge and experience about the stock market, trading, and investing.

Stock trading can be a brutal industry especially if you are new. Watch my free educational training videos to avoid making large mistakes and to just continue to get better.

Stock trading and investing is a long journey – it doesn’t happen overnight. If you are interested to share some insight or contribute to the community we’d love to have you subscribe and join us!

STOCK TRADING COURSES:

— http://tradersfly.com/courses/

STOCK TRADING BOOKS:

— http://tradersfly.com/books/

WEBSITES:

— http://rise2learn.com

— http://criticalcharts.com

— http://investinghelpdesk.com

— http://tradersfly.com

— http://backstageincome.com

— http://sashaevdakov.com

SOCIAL MEDIA:

— http://twitter.com/criticalcharts/

— http://facebook.com/criticalcharts/

MY YOUTUBE CHANNELS:

— TradersFly: http://bit.ly/tradersfly

— BackstageIncome: http://bit.ly/backstageincome

source

thanks for the great content!

Easiest to understand bid/ask explanation I've seen so far. Other videos I've watched present it from the point of view of the broker. I needed to hear it from my point of view as a buyer or seller. Thanks

very well explained!

The way through which a broker makes profit is called spread. It

lies in between ask and bid price. Traders want to have lowest trading spread

because it increases trader’s profit. But we hardly find a low spread providing

broker. Trade12 charges low trading spread to their traders and even it is seen

in commodities.

*here bids are in 10 million plus and ask is 2.6m only , still the price slips , how to avoid this trap *?

What if i short?

Great explaination sir.. ?

This guy is great! Soothing and informative teaching skills.

How come sometimes the spread is small and sometimes it is huge.

SO YOU ASK TO BUY A STOCK – USE THE ASK PRICE

AND YOU BID TO SELL THE STOCK – USE THE BID PRICE

Perfect! I didn't know what the difference meant. I was setting orders to the spread thinking this was good. I gave the market makers some money this week on paper, so I don't want to do it when I finally get to go live. Thank you Sasha!

You speak very well. Thanks

But what makes the price move?

i'm on a budget. I got $5 to invest… now make me a billionaire

Hey Sasha, great video. I have a question about bid or ask size. If I have a look at yahoo finance for instance and im looking at appl. It shows Bid as 169.93 x 800 and Ask as 170.05 x 100. I understand the bid and ask but the bid/ask size is what im confused with. Does this mean that there are 100*100 = 10,000 shares available to purchase at the Ask price of 170.05?

really nice! I subscribed.

Thank you ☺

Bid/Ask is very confusing term because I don't know who is doing the bid and who is doing the ask. thanks for this video; clear and good.

i wish ur my teacher …the whole thing became clear and simple now

what is the minimum amount of shares i can buy ?