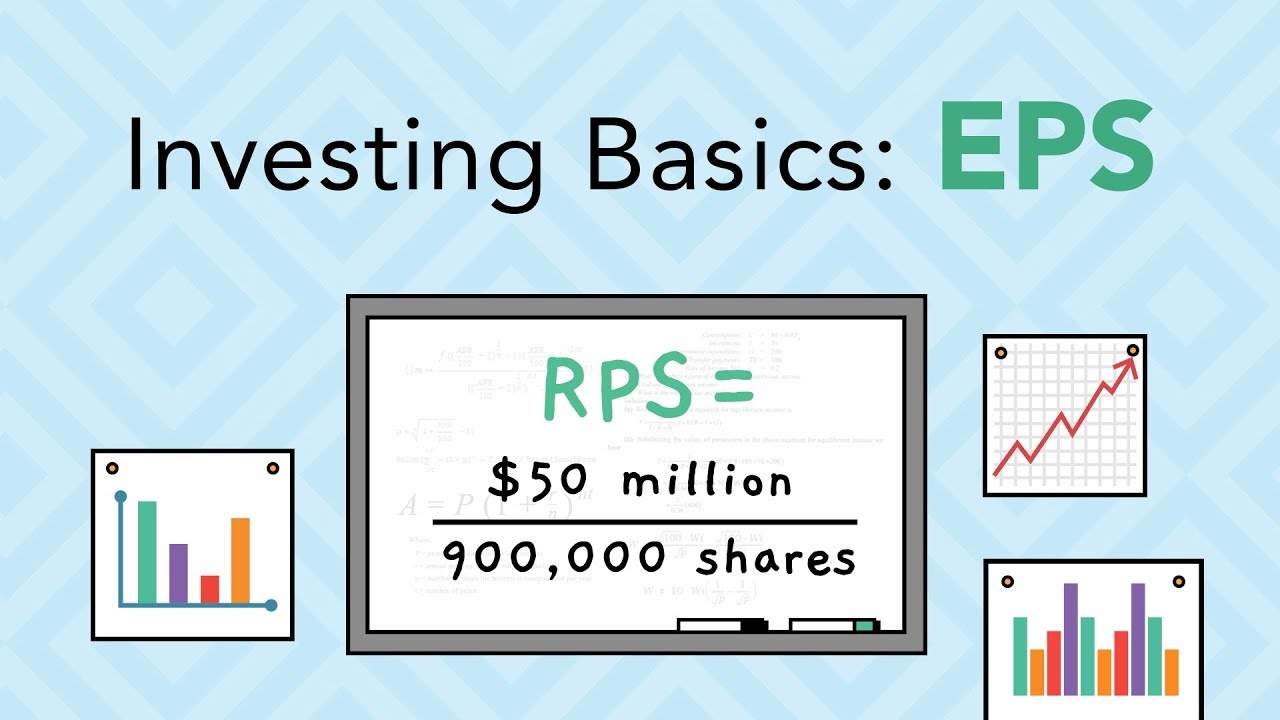

What does earnings per share represent in the world of investing? In this video I explain this invaluable term and how knowing what it is on a company by company basis can help you greatly when it comes to understanding a stock or business. http://bit.ly/2ERUMyK

Are you looking to start investing? Download my FREE investing quick start guide by clicking the link above.

Looking to master investing? Attend one of my FREE 3-Day Transformational Investing Workshops. Apply here http://bit.ly/r1workshop

_____________

Learn more:

Subscribe to my channel for free stuff, tips and more!

YouTube: http://budurl.com/kacp

Facebook: https://www.facebook.com/rule1investing

Twitter: https://twitter.com/Rule1_Investing

Google+: + PhilTownRule1Investing

Pinterest: http://www.pinterest.com/rule1investing

LinkedIn: https://www.linkedin.com/company/rule-1-investing

Blog: http://bit.ly/1YdqVXI

Podcast: http://bit.ly/1KYuWb4

eps, financial reporting, financial statements, growth rate, valuation of a company, stock market, investing basics,

source

Hey folks, thanks for watching today. I am happy to see so many of you enjoying it. If you are hungry for more basics of investing explained, check out my free quickstart guide: http://bit.ly/2ERUMyK

who has a finance exam coming up?

You are hot, Phil.

It's accrual, not cruel.

Great information Phil what I would like to know is the different between EPS and HEPS?

啄木鸟

Very knowledgeable and in-depth. I love this video. Thank you sir..

Love your videos..binge watch on the weekends!

enjoyed watching this thank you but I couldn't stop laughing at "cruel accounting" hehehehehe

hey phil town, bought and read your rule #1 book, really good. I have a question – what is your minimum recommend earnings yield? 10% as well? Or can it be lower, e.g. 7%?

Isn't EPS basically a measurement of how valuable the company is per share? And in that sense, how is it different from just looking at the stock price?

Great video

Thank you sir, great video, I was confused but now because the great educational video and patience, I do understand, thanks and God bless you. Hope to see more educational video from you, again thanks

Respectfully;

Andy

Very well explained! Thank you!

Thanks for your video, what is difference between net profit and net income?

This sounds so professional until it says "cruel accounting" lol i think he means accrual accounting

Hi Mr. Phil, i already read your book Rule n.º1, and i had difficulty to calculate the future eps, so i can't calculate correctily the SP and MOS.

Can i use the future p/e that some financial sites (ex: Yahoo finance or MSN Money), post for the stocks?

If the EPS and OCPS growth rate over the long period of time is around 20% but sales and BVPS is around 2%, that tells you they reduce the expense and grow the profit or something else? I thought they know how to reduce the cost of their operation.

i think EPS divided by share price is an even better metric for comparing companies. Otherwise you're not taking into account how expensive the stock is.

Thanks informative video.

Really good explanation of EPS indicators showing benefits AND also warnings of how some companies can use it to drive UP the stock price/dilute the stock

I loved it! Very well explained 🙂

Thank you!

Hi Phil, I am looking into a company that has Meaning to me, with more than 10% growth rates in most of the big 5 numbers. However, its EPS shows a negative growth rate. What does this mean if you say sometimes EPS can be deceptive?

Thanks!

https://solargroup.pro/ctd774

Hi Phil,so the point is whether the company has good EPS its doesnt exactly mean the company stocks are worth to buy?Investor still need to look at others aspect such as P/E Ratio,book value,managements etc is that right?

*Accrual

Kindly make a vedio on why issuing stock options benefits the management but its not good for us..i have read dis on the intelligent investor but couldn't understood dis properly.

accrual not cruel

Thank you so much for the clarification!

This is valuable. One of the items on the reports we can use to understand companies. Thanks!

Love all of your videos Phil. Question though, how can we compare earnings to cash flow in a company?

I work in a company that is buying back it's shares. The company has poor strategy with little innovation. Quite shady.

4:07 cruel accounting? I think this is a typo, as funny as it sounds ?