Ep 108 : Trading Stocks vs Options (Which is Better)?

★ SUMMARY ★

if you are new to trading options the differences behind trading stocks and options can be confusing.

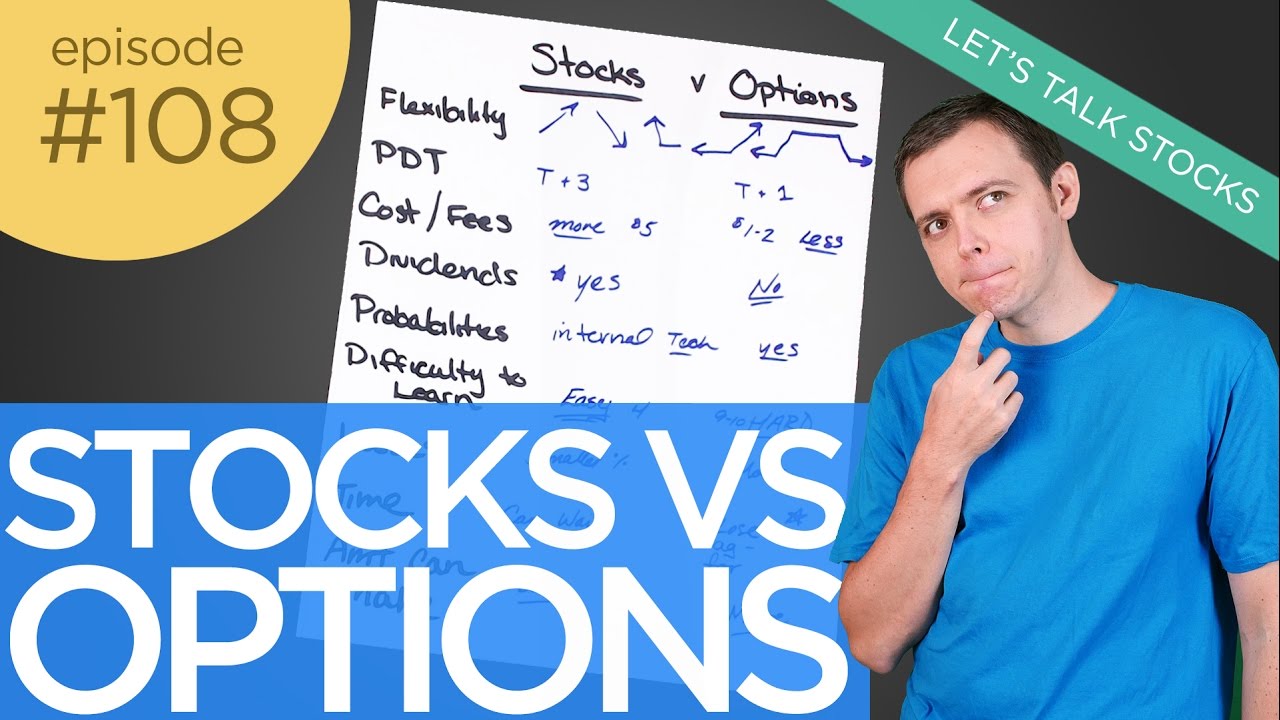

In this week’s video what we will cover is some of the main differences behind trading stocks and options that you understand the advantages and disadvantages behind one or the other.

Some of the things that we will cover will include the flexibility behind trading options versus stocks, pattern day trader rule, costs and fees, dividends, probabilities, the ability to learn, time value and time decay and the profit potential behind options versus stocks.

As your education continues to expand you will have more flexibility when it comes to options than with stocks. It can also be much more beneficial as far as commissions bill trading options but this of course depends on your broker. Some of the disadvantages can include no voting rights with options and you also do not get a dividend.

However the flexibility when trading options can be a huge advantage over stocks and it’s important that you evaluate the risks to the potential reward when placing any trade.

Posted at: http://tradersfly.com/2016/10/ep-108-trading-stocks-vs-options/

★ SHARE THIS VIDEO ★

★ SUBSCRIBE TO MY YOUTUBE: ★

http://bit.ly/addtradersfly

★ ABOUT TRADERSFLY ★

TradersFly is a place where I enjoy sharing my knowledge and experience about the stock market, trading, and investing.

Stock trading can be a brutal industry especially if you are new. Watch my free educational training videos to avoid making large mistakes and to just continue to get better.

Stock trading and investing is a long journey – it doesn’t happen overnight. If you are interested to share some insight or contribute to the community we’d love to have you subscribe and join us!

FREE 15 DAY TRIAL TO THE CRITICAL CHARTS

— http://bit.ly/charts15

GET THE NEWSLETTER

— http://bit.ly/stocknewsletter

STOCK TRADING COURSES:

— http://tradersfly.com/courses/

STOCK TRADING BOOKS:

— http://tradersfly.com/books/

WEBSITES:

— http://rise2learn.com

— http://criticalcharts.com

— http://investinghelpdesk.com

— http://tradersfly.com

— http://backstageincome.com

— http://sashaevdakov.com

SOCIAL MEDIA:

— http://twitter.com/criticalcharts/

— http://facebook.com/criticalcharts/

MY YOUTUBE CHANNELS:

— TradersFly: http://bit.ly/tradersfly

— BackstageIncome: http://bit.ly/backstageincome

source

Very helpful videos. Cheers man.

I stole my grandma's kidney transplant money to invest in your training course. Thank you I will win the money back after learning and replace the money 10 fold so my grandmother can live. Thank you so much!!!!!!!!!

Thanks for your videos. They are all so helpful.

Hi Sasha, what is the difference between the training/seminar videos in the traderfly vs rise2learn. Thanks.

I like put selling, but unless you have a marginable option account my broker freezes the full value of the put out of my account balance.

If you have a lot of capital selling puts is great, but I can trade stocks on margin and buy twice as much.

if I'm 15 and I learned stocks . do I have a chance to learn options ? they are much better for big profits and a better life ?

i like option i think its less risky is that true thanks

Thanks

sasha your the man thx for the videos learnt a lot .

cheers

are you russian born american? lol

Hi Sasha!

Nice video! I just wanted to ask you about the trading simulation you're using in this video. I want to start papertrading but i cant find any detailed simulations. The one you used in the video however seems very complex and detailed, and i would like to use it. What is the name of the simulation, where can i find it and does it cost any money?

Thank you 🙂

Can't wait to get the money to buy that course. Thanks for doing what you are doing.

what are your thoughts on Timothy sykes

Nice video. Was with you for over 1 year now. Good job Sasha.

I've been needing some help with trading

I was here.

Easy to get tricked by Prob. ITM…. important to know that the math behind it is relatively simple. Many treat it like some kind of crystal ball.

hi Sasha I've been following u for quiet some time now…u were talking about some option trading course…where can I find it…can u give the link for option trading course?