In this video, I’d like to share with you the difference between calls and puts. If you’re just getting started, you might be wondering, what does each one mean? What can I do with them and how can they benefit me?

First, you need to understand the basics behind an option. An option is a contract that gives a buyer a certain right. Options can be bought or sold. Even if you don’t own the stock, you can still trade options. It’s like a dealer selling a car first, before that car is even in his inventory. He’s selling it to you before it’s even in the showroom, and then they custom make it and order it.

When people are just getting started, usually they’re going to focus on buying an option, which is basically a contract, a call or a put.

General option concepts.

When you purchase a call, you have the right, but not the obligation to buy the stock at the strike price. Meaning if you own a call contract, you can buy that stock at a cheaper rate. if that stock explodes to a million dollars, you can still buy it at the strike price, for example $100, and then sell it for the current price.

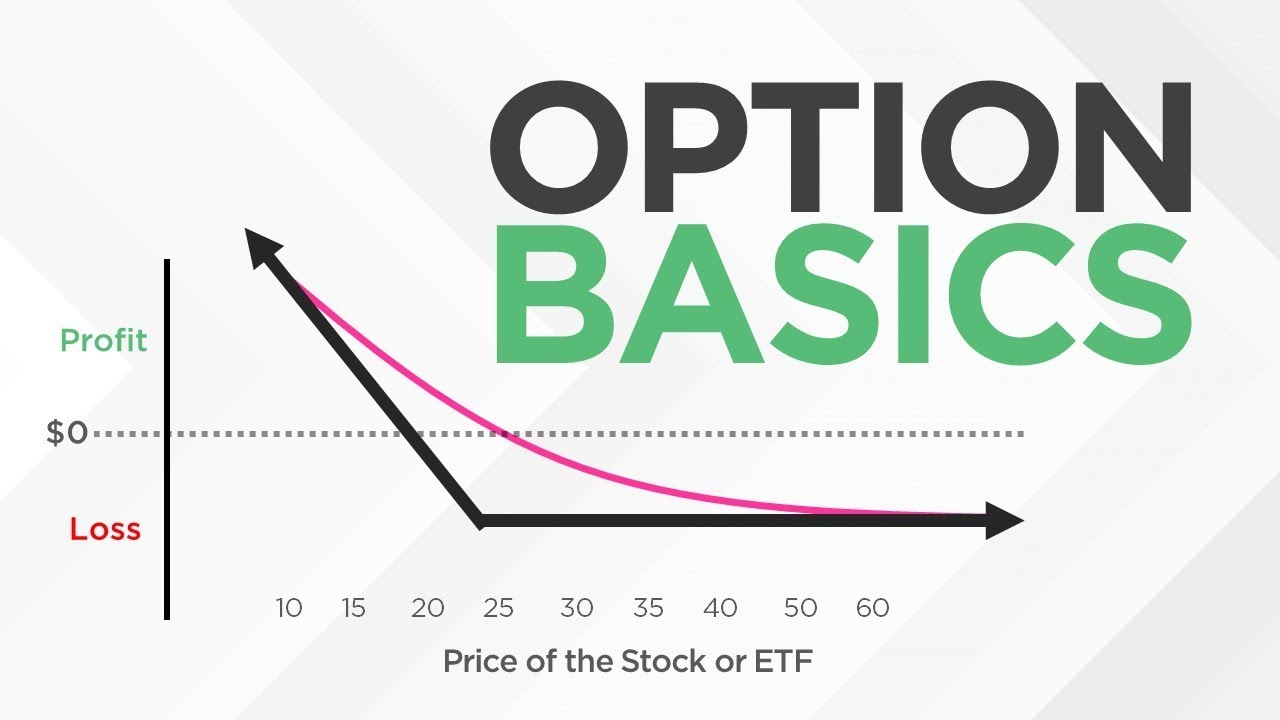

When you purchase a put, you have the right but not the obligation to put that stock to someone else at the strike price. If you own a put contract at $40, and the stock price goes down to $1, you can put that stock to someone else at the $40 strike price, because that is the strike price that you own it at.

Option traders usually don’t deal with the stock. Meaning they don’t usually put the stock to someone else, or they don’t buy the stock from a call if it works out in their favor and then sell the stock back in the open market. Because doing that means three times the amount of trades and it’s unnecessary.

Instead what typically happens is, the contract’s value changes with time as that stock moves up or down, so they trade the option contract for more or less money.

If you’re buying a call, you want the stock to go up. If you’re buying a put, you want the stock prices to go down. If you’re a seller, it works in reverse. If you’re a seller of a call, you want prices to go down, and if you’re a seller of a put, you want prices to go up.

Buying a call or buying a put is generally the starting point for understanding the basics and fundamentals of options, even though that’s not necessarily what you always want to do.

Many professionals are sellers of options. They’re looking to sell puts or calls. However, there are some issues when you start looking at selling option contracts, because there is unlimited loss potential, so you need to be very careful. However, it can be very beneficial, if you understand and know what you’re doing.

Posted at: http://tradersfly.com/2017/11/calls-vs-puts/

★ REGISTER FOR A FREE LIVE CLASS ★

http://bit.ly/marketevents

★ GETTING STARTED RESOURCE FOR TRADERS ★

http://bit.ly/startstocksnow

* Please note: some of the items listed below could and may be affiliate links **

* Trading Software / Tools *

Scottrade: http://bit.ly/getscott

SureTrader http://bit.ly/getsuretrader

TC2000: http://bit.ly/gettc2000

TradeKing: http://bit.ly/gettradeking

TradeStation: http://bit.ly/getstation

★ SHARE THIS VIDEO ★

★ SUBSCRIBE TO MY YOUTUBE: ★

http://bit.ly/addtradersfly

★ ABOUT TRADERSFLY ★

TradersFly is a place where I enjoy sharing my knowledge and experience about the stock market, trading, and investing.

Stock trading can be a brutal industry especially if you are new. Watch my free educational training videos to avoid making large mistakes and to just continue to get better.

Stock trading and investing is a long journey – it doesn’t happen overnight. If you are interested to share some insight or contribute to the community we’d love to have you subscribe and join us!

FREE 15 DAY TRIAL TO THE CRITICAL CHARTS

– http://bit.ly/charts15

GET THE NEWSLETTER

– http://bit.ly/stocknewsletter

STOCK TRADING COURSES:

– http://tradersfly.com/courses/

STOCK TRADING BOOKS:

– http://tradersfly.com/books/

WEBSITES:

– http://rise2learn.com

– http://criticalcharts.com

– http://tradersfly.com

– http://backstageincome.com

– http://sashaevdakov.com

SOCIAL MEDIA:

– http://twitter.com/criticalcharts/

– http://facebook.com/criticalcharts/

MY YOUTUBE CHANNELS:

– TradersFly: http://bit.ly/tradersfly

– BackstageIncome: http://bit.ly/backstageincome

source

Options are difficult and confusing as hell

How EXACTLY does someone profit when someone buys an option thats in the money.

A question concerning crypto currencies: What do you think of Bitcoin and Litecoin Now in December 2017 ???

Nice Video, thanks for the refresher.

Thanx for explaining in tos

Hey Sasha, thanks for your efforts and energy that you are sharing with us,it is very helpfull.i see that you are interested in psyhology,have you ever read something from Jung or Alan Watts?if not check it out it,thanks again keep up with good work 🙂

Options are like drop-shiping lol

That's hilarious – I made an options video a couple weeks ago and used a coupon analogy and McDonald's! Lol

thanks bro. for loading very useful video link.. kind regards