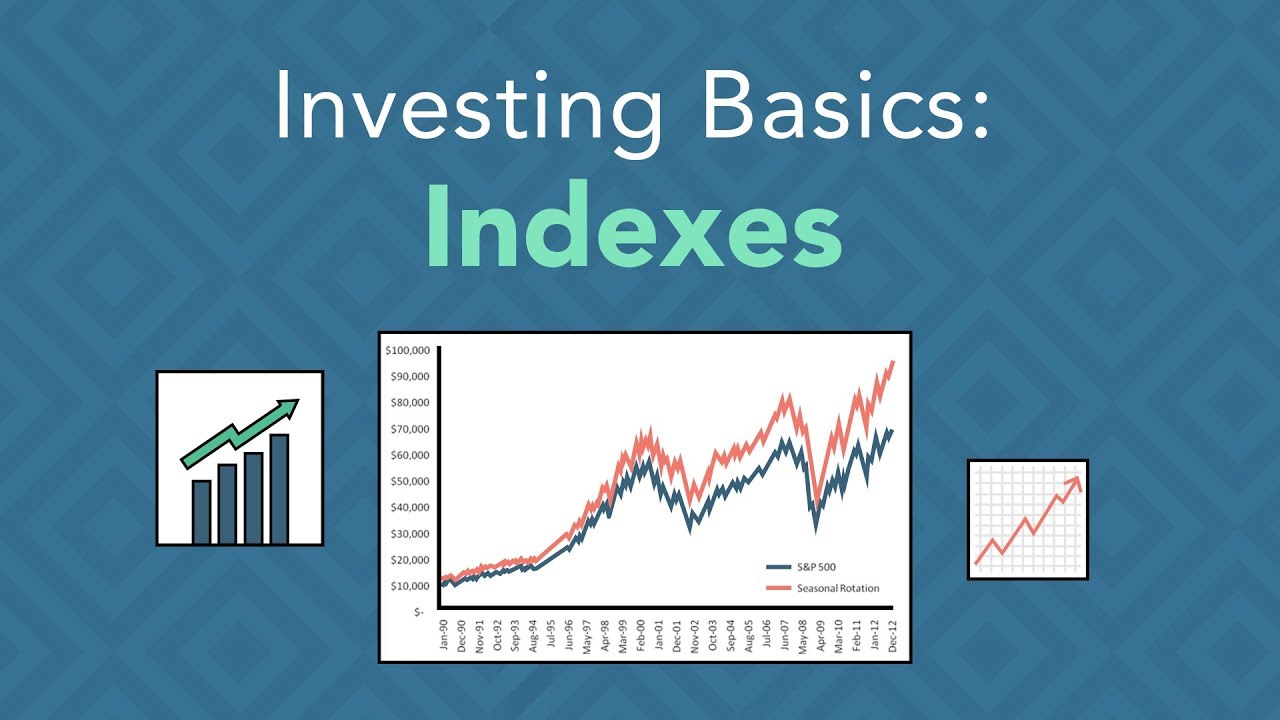

In this video you’ll learn more about the basics of index investing and the historic returns investors have been seeing in the S&P 500, Russell 2000, Dow Jones Industrial Average, Nasdaq 100, and other popular indexes. But is it the best investment for you? http://bit.ly/2KrQAtL

Are you confused by some of the investing terms used on this channel or investing in general? Download my free glossary PDF by clicking the link above.

Looking to master investing? Attend one of my FREE 3-Day Transformational Investing Workshops. Apply here http://bit.ly/r1workshop

_____________

Learn more:

Subscribe to my channel for free stuff, tips and more!

YouTube: http://budurl.com/kacp

Facebook: https://www.facebook.com/rule1investing

Twitter: https://twitter.com/Rule1_Investing

Google+: + PhilTownRule1Investing

Pinterest: http://www.pinterest.com/rule1investing

LinkedIn: https://www.linkedin.com/company/rule-1-investing

Blog: http://bit.ly/1YdqVXI

Podcast: http://bit.ly/1KYuWb4

index funds, index fund, stock market, mutual fund, mutual funds, investing in index funds, exchange traded fund, index funds for beginners, how to buy an index, index funds explained, investing 101,

source

Hello Rulers! Thanks for watching today's video – I hope you feel a bit more confident about indexes. Investing terminology can get a little tricky, make sure you download my free financial terminology glossary. It will save you a headache or two >> http://bit.ly/2KrQAtL!

As investors panic and sell off their index funds, there are also investors who buy on a dip so they purchase the underlying stocks or the index too. Plus, the etf or index mutual fund manager can't allow his funds to diverge from the actual undex too much.

VTSAX for life

I wonder how many people owning index funds have sold them off after watching this video haha

What is being said in this video makes sense, but I don’t understand how investing in individual stocks would help you. For instance, Buffett has huge stakes in Apple, Coke, and Kraft. Every index fund has those stocks in it. If a selloff is occurring in index funds, the individual stocks of those companies would also go down as a result of the index selloff.

How do you guys feel about SPHD? I know the expense ratio is too high for some investors?

Phil you have the heart of a teacher.

Thanks Phil. This is very interesting. 30% of the market invested in indexes is a fairly large percentage. Need to think and talk about this one. I had no idea this happened at all!

I have bought index funds. Currently about 5% of my portfolio is in index funds but that is likely to significantly increase in the next few years when I start selling out of bank stocks (since they always seem to underperform). It does scare me that 30% of the US market is owned by index funds but what concerns me most about that is that the fund manager gets the voting rights. I just don’t believe they will look out for the best interests of the company. Hopefully there is a law passed in the near future that prevents them from voting.

when the market gets bad , mutual funds and individual stock buyers will sell all of their stocks also..not just index funds.

Many retirement funds don't allow investment in individual stocks, only ETFs and mutual funds; for instance, in New Zealand we have the state retirement scheme Kiwisaver which has a limited number of fund providers. How would you suggest investing funds in these types of schemes, where the only choices are passive ETFs or more traditional mutual funds?

If the index falls when the funds have to sell stocks, doesn't that mean that the index rises when the funds buy stocks? And – by that logic – aren't index funds not already helping value investors in that way? Could there be a bubble forming around this?

Can we calculate the sticker price of an Index fund so that we can buy when it's undervalued and sell when overvalued?

I saw an investor who claims to teach this in his course. Is that true? Can this really happens?

Okay so I’m not sure if I should invest heavily into QQQ or VOO. Invest into QQQ for the next 30 years, wouldn’t that be the answer to the best index out there? Averages about 20% a year lately. Dot.com bubble showed it’s volatility although.

My grandmother is in her mid-seventies and doesn't really have any retirement savings and is living off of Social Security. I'm thinking about taking a couple thousand dollars of my income from Trading options and putting it into a brokerage account for her investing in sphd high dividend low volatility ETF that tracks good dividend-payers. It's about 50 companies that pay dividends such as Procter & Gamble Johnson & Johnson Verizon and so on. It pays a $0.136 dividend every month and while she could probably get higher dividends by investing in single stocks instead of the index she would then get the payments quarterly and have quite a bit of single stock exposure.

There's a reason Warren Buffet designated the Trust for his heirs to invest 90% in the Vanguard 500 Index and 10% in the Total Bond Index and that reason isn't because Buffet doesn't know any competent money managers to handle his estate. Its because there's 50 years of empirical economic research that proves that indexes outperform 90% of all professionally managed portfolios. If you are picking individual stocks as your retirement strategy then you are a fool and things are not going to work out very well for you.

This video is not based on fear ? Aren't you tryig to scare people from Index Funds ? Only novice investors would sell an index fund like S&P500 because it is falling. True investors will simply see this as an opportunity to buy more S&P500 shares for a cheap price, just like buffet would do with a quality company. Basicly, if you are stupid and retarded, yes this is what you would do. I wouldn't assume everyone is in this category 🙂

Also, for your example where the price goes down so people sell and since people sell, the price goes down, for that to happen would mean no one is doing any active investing. Could you think of a world where there would be no active investments ? The obvious answerr is easy : NO. Why ? Because let's say 100% of people do index investing like You say. It means that if 1 person on earth decides to do active investing it will be hugely profitable, since that person will be the only person determining the real price and will therefore easily profit from passive investor tracking the market. What would then happen if a person was able to generate huge returns by being active ? You guessed it right, more and more people would start doing active investing again, thus maintaining a balance between active and passive investing where active can be profitable, but not so much that it is worth it to be a passive investor.

If I keep seeing bad videos like this, I'll unsubscribe, because it is plain bad advice and false hypothesys. People are far better off following the market at a low cost, which is mainly represented by institutional investors, retirement plan administrator, mutual funds, etc. and limiting their cost than trying to beat those institutional investors that have more knowledges, better tools, bigger teams than any individual investor trying to build wealth.

You can do better than this.

If you buy index stocks are you still going to get dividends as if you'd buy the single companies stocks?

Hi Phil, Thanks for the great videos and value you provide. I started out investing in index funds, based on information and advise from big names. Despite getting reasonable returns, I have now built confidence and knowledge to invest Rule #1 style and have made some good steps and returns so far. Still have my index funds in portfolio, but not adding to it anymore, instead searching for those great businesses and gems to pick up. Thanks for all the advise and guidance!!

I only use ETFs either as quick global heat map in order to find beaten down markets. If there is such a market such as Brasil, russia and Turkey recently. I look to find good stocks there or If the market is hardly accessable i buy the ETF. Brasil ETF made me an easy Low risk 100% gain last year. So it doesnt have to be US if the price is right…

"About 30% of the market is now just indexes" ? Where did you get this data? Is it include all of index-fund and ETF? I'm just thinking when this percentage will be over 50%. I read the report of Vanguard in last year. Their AUM is growing very fast, and sounds unstopped.

Thank Phil for your video.

When you criticize index investing, it sounds to me that you rather criticize fixed allocation investing, where whatever the market valuation, the investor keeps a stock / bond ratio in its portfolio that's independent of market valuation (let's say 100-age rule, or similar).

However, what is wrong about index investment with variable ratio based on market valuation? I see it as a hybrid between the passive fixed allocation index investment that you rightly (in my opinion) criticize and the active individual stocks investment.

30%?!

Another 1929 isn't the worst thing if you're well prepared.

I’m 16 years old and i have interest in investing. Can you recommend me some books that will help me learn about money?