The world of cryptocurrency investing and trading can be daunting due to its potential for volatility in the marketplace. A class of altcoins called stablecoin has been created to rectify this.

These coins use several methods to stabilise the volatility common in the marketplace. The stability has the added benefit of making this crypto class a safer bet for those who would otherwise be put off dipping their toes into the market.

This article will introduce you to stablecoin before detailing the most common variants being created.

What Is Stablecoin?

Stablecoin is the most recent general type of cryptocurrency/altcoin in circulation. The point of their existence lies in the need for price stabilisation due to the volatility of the crypto marketplace. This is usually achieved by pegging the coin to a reserve asset such as a fiat currency.

They have increased in popularity as they provide two positives: enabling investment and trading in the world of secure and private cryptocurrencies while maintaining the stability usually attributed to regular fiat currencies.

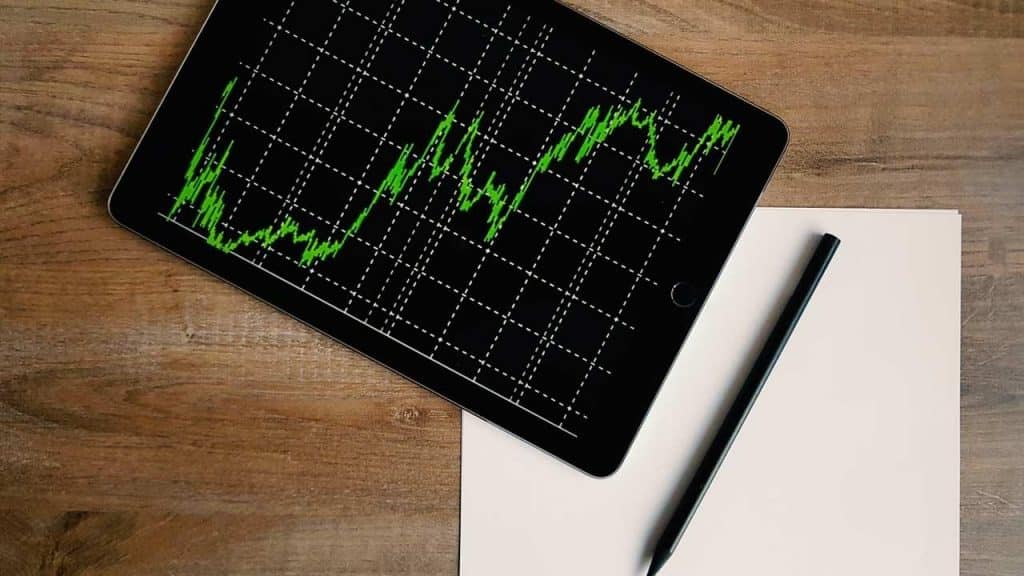

Market Volatility

One need only look at the most well-known cryptocurrency, bitcoin, to ascertain the volatility of the marketplace in which these digital assets exist. From a valuation high in 2017, there was a mass sell-off in coins from January 2018, which resulted in the renowned Bitcoin crash. This caused even the most popular cryptocurrency in the world to lose approximately 65% of its market value.

While this is the most egregious swing in market value, general day-to-day fluctuations can be all over the place. Even in a few hours, a currency’s valuation can change by a few percentage points.

The upshot is that this short-term volatility makes most cryptos, including bitcoin, unsuitable for the average person. For everyday use, a currency will ideally behave as a medium of exchange with relative stability over long periods. If stability isn’t achieved, dramatic price fluctuations result in most people not jumping on board.

This is where stablecoin comes in to fill that much-needed gap in the market. The idea is to maintain purchasing power with the lowest achievable inflation to encourage currency spending. They seek to achieve this preferred behaviour by backing their valuations to an external reference to enable increased price stability.

Maintaining Price Stability

Price stability does not tend to happen in a vacuum, however. In the case of fiat currencies, there are two reasons for their relative price stability.

Firstly, the values of the currencies are underpinned and backed by the strength of the governments that issue them.

Secondly, there are sufficient actions upon the market by authorities (such as central banks) to maintain the market valuations within an acceptable range.

As fiat currencies are backed by governments and under authorities’ control, they tend to remain relatively stable. If a currency were to fluctuate, the central bank would attempt to control its demand and supply to maintain its stability.

The problem with cryptocurrencies lies in their lack of control concerning their stability. An external asset neither backs its valuations nor is there a central authority to act as an arbiter to control the prices as needed.

Thus, this new stable class of coins is an imperative movement toward more stability in the marketplace. They are digital coin assets with features of both fiat currencies and cryptocurrencies.

Types Of Stablecoin

There are three common variants of a stablecoin. They are categorised according to which asset they are pegged to if any.

1. Fiat-Collateralised

Firstly, there are the fiat-collateralised cryptos. These currencies purport to be pegged to known fiat currencies, usually the US dollar, the pound, or the euro. A reserve of fiat currency is also used as collateral. This reserve enables the issuance of an acceptable number of tokens into the market and is maintained by independent guardians and often audited to ensure compliance.

While the US dollar is the usual currency they are pegged to, other forms of collateral back a sub-category known as asset-collateralised cryptos. Precious metals in the form of gold or silver reserves can be used, or even oil.

Tether is a well-known and popular example of fiat-collateralised crypto. It has a market value tied to one US dollar and is backed by dollar reserves. It’s considered a safe bet by many in the community. It should be noted, however, that Tether’s promises of continual auditing have not been forthcoming as of this writing.

2. Crypto-Collateralised

The second class is the crypto-collateralised stablecoin. These are similar to fiat-collateralised stablecoins, but instead of being backed by a fiat currency, they are backed by other types of cryptocurrency.

Due to the nature of cryptocurrencies with their high market volatility, these coins are “over-collateralised”. This means that more currency is needed to act as a reserve for issuing these coins concerning their fiat-collateralised counterparts. Effectively, coins in this category need to be backed by more cryptocurrencies than their fiat-backed equivalent.

For example, to accommodate a 50% change in the reserve currency, $5,000 of a cryptocurrency would be needed in reserve to enable the issuance of $2,500 of a stablecoin.

An example of this category of crypto is Dai. This cryptocurrency is pegged to the US dollar but can be pegged to a few other cryptocurrencies. Adding to its stability is that it’s run on Ethereum’s blockchain.

3. Non-Collateralised (or algorithmic)

The third category is the non-collateralised (or algorithmic) stablecoin. These types don’t peg themselves to any reserve but instead use a mechanism which maintains their stability. This ensures, as far as possible, that the values of the coins are maintained within acceptable bounds.

The mechanism is essentially an algorithm that acts as a central authority to regulate the price. The algorithms maintain the volume of the altcoin in question to prevent fluctuations in value. These digital currencies are often pegged to external assets such as gold or fiat currencies. This coin category is also the most transparent, as anyone can audit its code.

These coins rely on smart contracts to supply tokens to the marketplace when there is an increase in value and to sell when the price drops below the peg. This is how the tokens remain relatively stable over an extended period.

For example, if the price of a coin pegged to one US dollar goes above one dollar, this would mean that the demand is too high for the coins. The algorithm would kick into gear by supplying new tokens to the market until the demand stabilises. The opposite will apply if the price falls below one dollar.

An example of a non-collateralised currency is BitBay, which is not backed by any assets but is maintained by what it calls its Dynamic Peg.

The Strengths and Weaknesses Of Stablecoins

Let’s take stock of what the above means for this class of digital currency.

Strengths

Firstly, there are a few reasons to invest or trade in stablecoin. The obvious positive is its minimisation of volatility in the marketplace, thereby ensuring higher levels of investment or trading security.

As a result, this could enable quicker integration of these currencies into more traditional financial markets. Fiat currencies still dominate these markets, but stablecoin is the first step toward increased interaction between these ecosystems.

An added benefit is that people who wouldn’t necessarily invest in crypto may start moving to these more stable investment and trading opportunities.

Weaknesses

That said, stablecoin does have weaknesses.

Firstly, in the case of fiat-collateralised coins, they are less decentralised than others due to the need for an authority to hold the asset reserves. This goes against the drive to adopt cryptocurrencies in the first place, but perhaps the future will find a happy medium between regular markets and the world of crypto.

Secondly, in the case of crypto-collateralised and non-collateralised cryptos, adopters need to trust the community that maintains them. The currencies’ longevity also depends upon the source code’s strength.

Despite these potential weaknesses, a stablecoin is a far safer bet than regular cryptocurrencies. They have increased the trend toward adopting these currencies and heralded a new phase in integrating cryptos into the world’s financial markets.

Conclusion

This article has introduced stablecoin as a class of altcoin that has grown in popularity over the past few years. Furthermore, we detailed the categories of stablecoin to introduce you to the types that one can invest in and how they operate.

Due to the crypto market volatility, these currencies may make the difference for people seeking to invest or trade in safer coins.