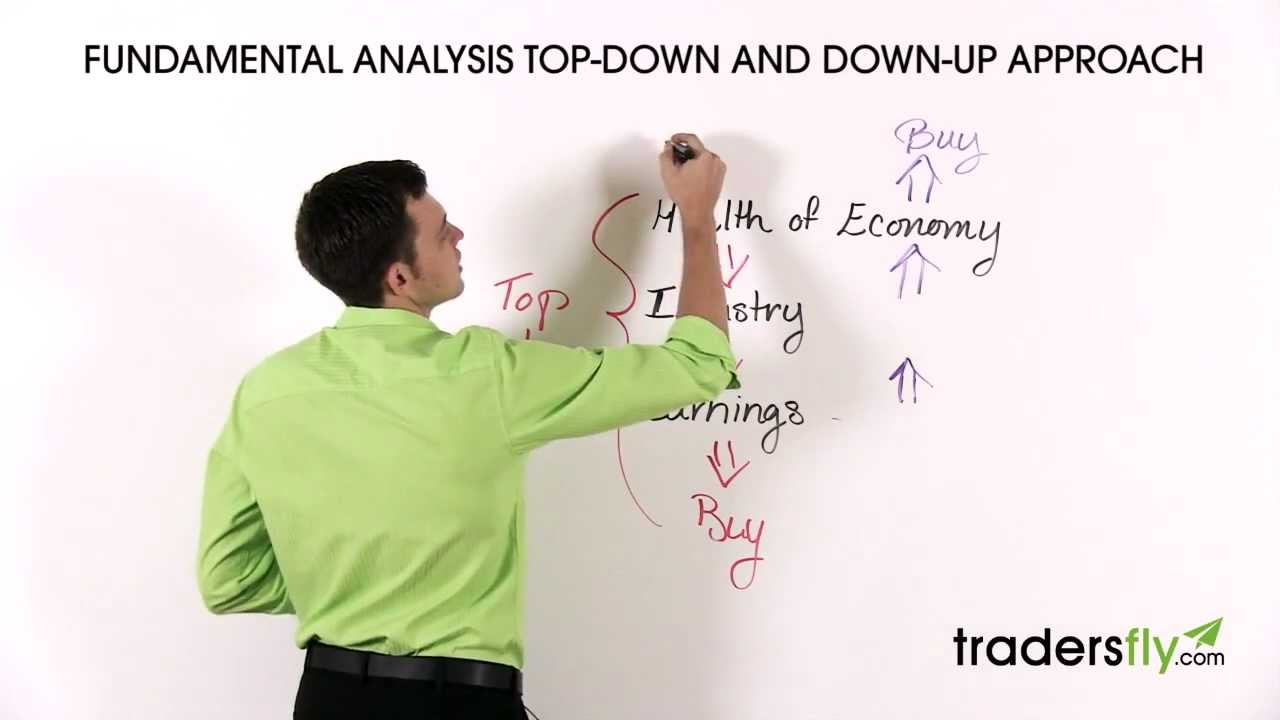

There are two ways to evaluate the fundamental analysis: top-down and bottom-up.

Fundamental Analysis Breakdown:

1. Health of Economy

2. Industry

3. Earnings

Top-Down Analysis:

-Checking the health of the economy, followed by the industry, followed by company earnings. If the company earnings are good, this is when you may decide to buy the stock.

Bottom-Up Analysis:

-Checking the earnings, followed by the industry, followed by the health of the economy.

★ SUBSCRIBE TO MY YOUTUBE: ★

http://bit.ly/addtradersfly

★ ABOUT TRADERSFLY ★

TradersFly is a place where I enjoy sharing my knowledge and experience about the stock market, trading, and investing.

Stock trading can be a brutal industry especially if you are new. Watch my free educational training videos to avoid making large mistakes and to just continue to get better.

Stock trading and investing is a long journey – it doesn’t happen overnight. If you are interested to share some insight or contribute to the community we’d love to have you subscribe and join us!

STOCK TRADING COURSES:

— http://tradersfly.com/courses/

STOCK TRADING BOOKS:

— http://tradersfly.com/books/

WEBSITES:

— http://rise2learn.com

— http://criticalcharts.com

— http://investinghelpdesk.com

— http://tradersfly.com

— http://backstageincome.com

— http://sashaevdakov.com

SOCIAL MEDIA:

— http://twitter.com/criticalcharts/

— http://facebook.com/criticalcharts/

MY YOUTUBE CHANNELS:

— TradersFly: http://bit.ly/tradersfly

— BackstageIncome: http://bit.ly/backstageincome

source

Thank you so much.. 😀

Thanks.

from india

In bottoms to top you buy first then see the earnings then industry then economy" lol

always good explanations thank you

Thank you helped me a lot!!!

Quick question. How can two companies have equal market caps but have different stock prices? How would you determine which one is the stronger buy?

wow awesome bro you are legend

thanks

I love ur videos ..seriously they ar useful and so simple …keep doing good work man thanks for ur support

helpful my study thank you

Helpful to my study

thank you for that brief session, explaining the differences of the two fundamental analysis types. now able to work on my school assignment…thanx again

I've just discovered your videos today Sasha, and I find them really useful and easy to understand. Thank you for making them.

I appreciate the effort you have put into this video, thank you!

If its any consolation, this video has helped me a lot. Finally someone that can explain the basics of fundamental analysis. Me and my high school Finance class project thank you!

hi i have been considering investments for a year now. i also understand that informed and educative decisions are vital. but i find it difficult to analyze the economy, industry and company (top-bottom). do you have any guidelines or simple steps detailed and focused stratagem on how to look at the health of economy, industry you are planning to invest and the company itself respectively? thanks. 🙂

Which approach do you recommend for beginning investors? Obviously it's best to know and understand both, but which approach do you find more beneficial.