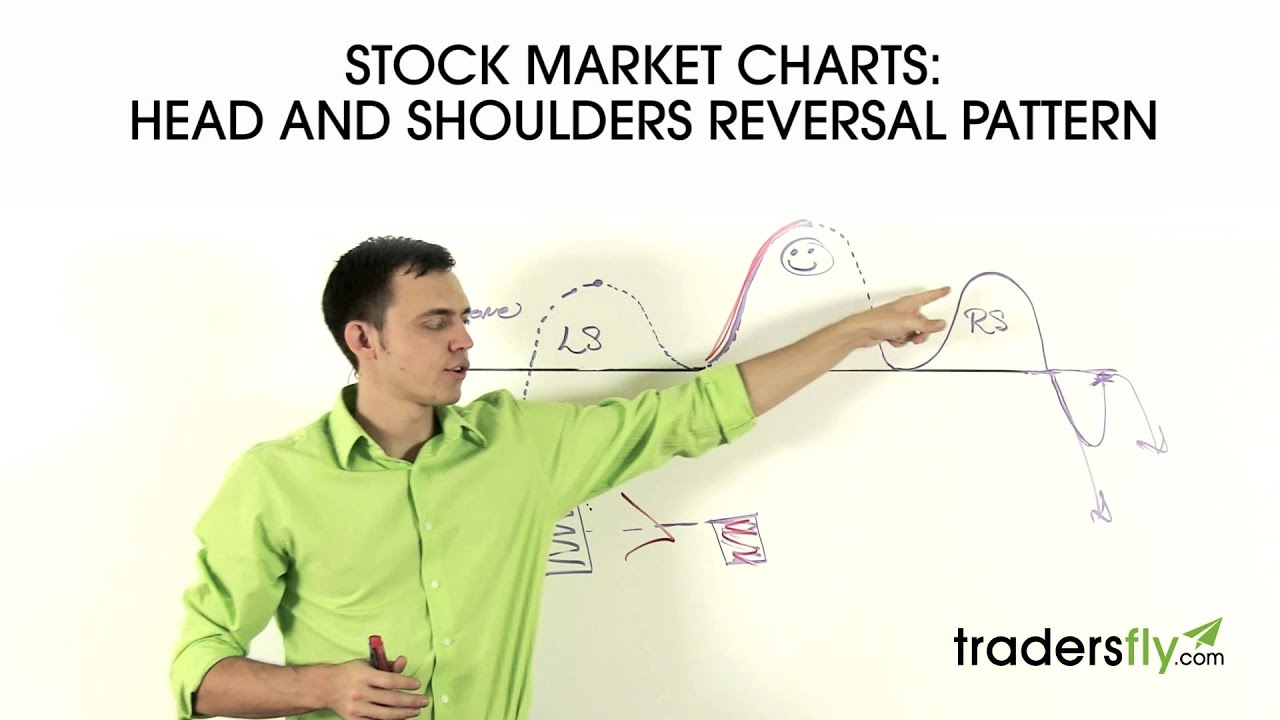

What is the Head and Shoulders Reversal Pattern?

-The stock bounces off of the support line three times, making a head and shoulders pattern

-On the first shoulder, the volume is high

-The volume is lower on the uptrend that creates the head

-People are not voting for the stock to go up. This low volume creates the head

-Important to understand: If the stock bounces and hits the support line again (after the last shoulder), the line becomes a resistance line. You want to make sure it doesn’t bounce down again because that would mean the stock is going below the resistance line.

-A three month pattern is healthier than a two day chart pattern

How to Trade On the Pattern:

-Typically, people wait to trade until the stock breaks the neck line region and they trade on the down side (if there is enough volume)

Continue to learn with me at: http://tradersfly.com/

Check out my courses at : http://rise2learn.com

Facebook Fan Page: http://www.facebook.com/tradersfly/

Get My Charts on Twitter: https://twitter.com/tradersfly/

source

Hi Sasha, ur videos r very helpful, I just wonder is this "head and shoulders reversal patter" good for day trading or swing trading?

Is there a difference between the Head and Shoulder pattern and the Triple Top ???

disliked. where's the entry, where is the stop loss?

could this be a double bottom?

Hey mate,

Might be an obvious but for INVERSE head and shoulders, would the volume bars switch roles? Should the left shoulders volume be less than the heads?

Thanks Sasha. Presumably you also expect to see further decreased volume on the right shoulder?

thanks for the video, do you feel that Nasdaq is going through a head and shoulder pattern and do you see a bullish uptrend or no now?

i was taught volume matters on bullish patterns and not for anything bearish

Good insight

Hi Sascha, Great Video. Can you also explain the pullback rate and what that represents? According to Bukowski it is for a H&S top pattern 50%. However, is that 50% regarding the move of the price before retracing or the retracing rate somewhere at the trend before meeting the price target?

example.

A) breakout price is 5 euros and target 2.50 ( so its a -2.50 move) is the pullback to be expected at 50% of 2.50 =1.25 at 3.75?

B) breakout price 5 euros and target 2.50 , with a pullback happening at a random point before meeting the target and retracing 50% from where it started retracing?

hope you could clarify.

best,

you're really help for beginers

excellent video, . It looks as if it's forming now.Question..why is the Nasdaq future over 400 pts. down.? For example todays current is 4795 but future is 4384? thank you

thank you, i have a quick question.

Do all or most patterns work both daily and Intraday?

Good informative video!!!

Sasha, thanks for replying, I am new to forex and have questions about a few things such as "trailing stops " etc, could I message you somewhere?

which time frame is this good for ? if I want to do day trades?

How does the volume come into play during the right shoulder? Should an increase provide confirmation or does it not matter?

Hi, a good example of this video would be the pattern Gogo had in 2013 Nov up to 2014. I liked the videos you provided, and I would be happy to share the examples I found for each of the pattern. Could you then, in return, upload more complicated patterns? I'll be happy if you can send me some directly and I would be happy to share your videos to others.

Thanks for the video. You explain this much more clear than most others.

how much money do you make on the market in a month?