What are satoshis?

In recent years, we have observed the growth and fluctuation of cryptocurrencies, especially Bitcoin and its fractions of currency, satoshis. Satoshis, or SATs, are the smallest fraction of a bitcoin.

Simply put, a Satoshi is more or less for a Bitcoin than a penny is for a dollar. Both are units of the same monetary system, but the penny is a smaller unit. The difference is that 1 dollar = 100 cents, while 1 Bitcoin = 100,000,000 Satoshis.

Using terms such as satoshis, or other small units, means that users avoid having to write sequences of zeros when very small volumes of the cryptocurrency are involved.

The smallest unit of a bitcoin, the Satoshi, is named after Satoshi Nakamoto, the anonymous creator(s) of bitcoin.

The history and background of the term

The term “sat” is most commonly used in current conversations about cryptocurrencies and blockchain. HoneyMiner, a Bitcoin mining software, pays the mining reward on SAT. There are also hashtags related to SAT on social media, and Lightning Torch, the payment of the Lightning network, is counted in satoshi.

Satoshi was introduced into the vocabulary of the cryptocurrency and blockchain industry in 2011. Still, it took longer to become a buzzword. The term is often referred to in cryptocurrency articles and podcasts.

The origin of the term may refer to the inventor of Bitcoin. However, the suggestion to introduce this term came on November 15, 2010. On this day, a BitcoinTalk user known as Ribuck proposed that 1/100 Bitcoin (0.01 BTC) be called a satoshi. This was the lowest value that could be shown in the interface at the moment.

The user made the proposal, but initially, no other BitcoinTalk user endorsed it. The idea was abandoned, and no action was taken on the suggestion until February 10, 2011. Ribuck made the same comment about the account unit denominations. This time, the user received positive feedback on a new topic. With Bitcoin users seeing the benefits of considering smaller monetary units, sat was introduced.

When was Satoshi created?

Satoshi’s origins derive from the early days of bitcoin and BitcoinTalk, a forum for discussions about the bitcoin ecosystem.

In 2010, a BitcoinTalk user known as Ribuck suggested that 1/100 of a bitcoin, or 0.001 bitcoin, was the smallest unit represented in the blockchain interface. He also suggested that he should be called Satoshi on a topic about Unicode characters for bitcoin.

Three months later, Ribuck suggested the same in a topic called “More divisibility needed—move the decimal point,” receiving positive feedback from other users about divisibility.

Eight days later, a new topic titled Bitcent appeared on BitcoinTalk, where a user named Kolbas gave this outline for the divisibility of bitcoin.

1 satoshi = 1 microbitcent (lowest name)

100 million satoshis = 1 Bitcoin

And this was agreed upon by all users of the topic, and Satoshi was born.

Are Satoshi and Bitcoin the same thing?

Yes, by joining 100 million Satoshis, 1 entire Bitcoin is formed. Similarly, the microgram and kilogram of gold continue to be a precious metals with 79 protons and an atomic mass of 197,966.

This characteristic of divisibility without loss of function is known as fungibility. Among the advantages of investing in Bitcoin is the possibility of auditing balances, the total number of coins issued, and making transactions autonomously.

- When buying or selling Satoshis, in fact, a small fraction of Bitcoin is being traded.

- This nomenclature helps in small transactions because moving BTC 0.00007383 brings risks in calculating the number of decimal places

- In the above case, it is easier to inform 7383 Satoshis, therefore, without the need for so many zeros in front.

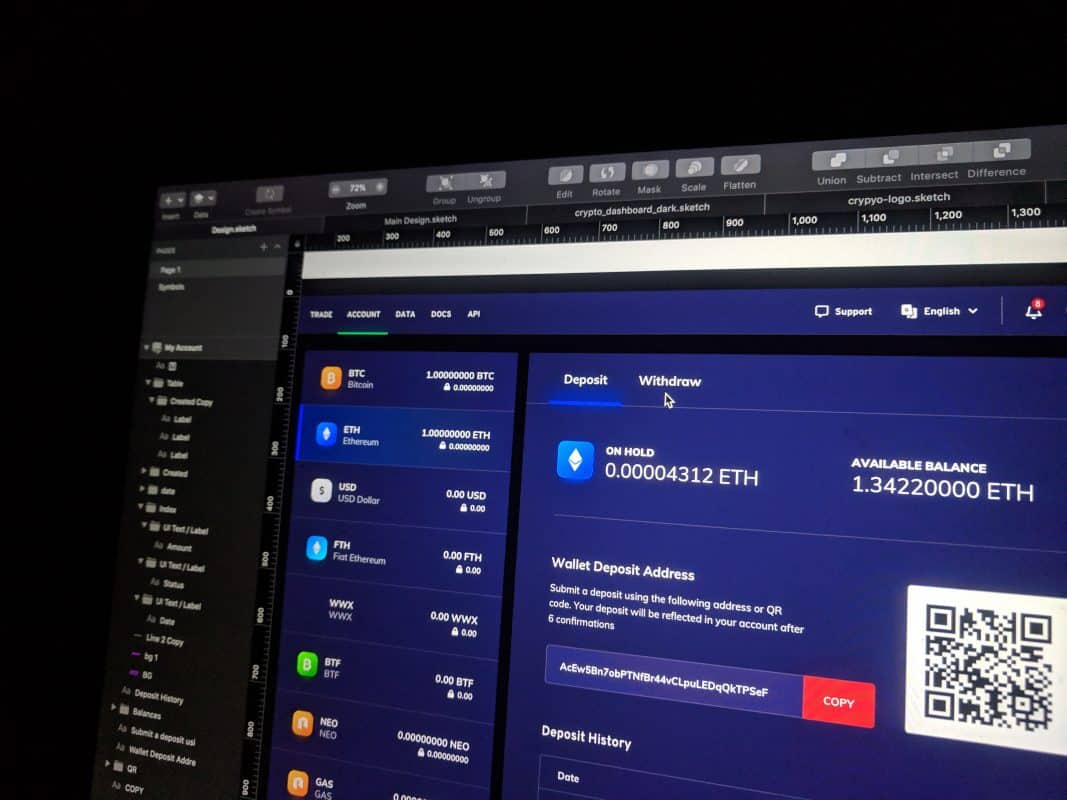

- Some websites and applications offer the possibility to display the quantities in Bitcoin or Satoshis, according to the user’s preference.

Where did the name Satoshi come from?

The satoshi is named after Satoshi Nakamoto, the anonymous person (or people) who published the white paper in 2008 that began the development of the bitcoin cryptocurrency.

The whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System” described the use of a peer-to-peer network as a solution to the problem of double spending found in previous cryptocurrency concepts.

What is Bitcoin?

Bitcoin is a 100% digital currency that only exists within the blockchain, a shared database.

The cryptocurrency works independently, without a central organization or controlling group.

Your transactions are guaranteed by a computational effort that requires a lot of energy, so the data is extremely secure.

The issuance of new Bitcoin coins was scheduled to be halved (halving) every 4 years.

The movements of fractions of Bitcoin (Satoshis) can be made 24 hours without the possibility of censorship and without depending on third parties.

How much does a satoshi cost?

Fiat currencies, such as the dollar (USD), the euro (EUR), the pound (GBP), and the real (BRL), have specific denominations for hundreds of units. Bitcoin works in a similar way. The currency is divisible into smaller units. This allows its use in a realistic environment. The constant price fluctuations of Bitcoin can make it very expensive. Without sufficient divisibility, it would be almost impossible to buy or sell on a large scale.

A satoshi corresponds to a decimal, seven zeros, and 1. It also includes the BTC ticker. Or it includes the ticker for forks, such as Bitcoin SV (BSV) or Bitcoin Cash (BCH). That’s 0.00000001 or 1.00 * 10–8 in scientific notation.

New cryptocurrency investors may find it prohibitive to invest in the purchase of several units of Bitcoin due to its high price. Although cryptocurrency can be bought fractionally, many people find it difficult to accept the high listing price. A large part of the cryptocurrency community requests that Bitcoin be listed in satoshis. This makes the offer more accessible and attractive.

Bitcoin is not the only currency that includes fractional units. The Ethereum cryptocurrency has wei. He honors Wei Dai, one of the first cryptocurrency developers.

Does it compensate for accumulating Satoshis?

Yes. Who started to collect R$ 50 per week of Bitcoin 1 year ago, invested R$ 2,700, and owns 1,150,000 Satoshis.

At the current quote of R$ 315,913 per Bitcoin, this contribution is valued at R$ 3,528, resulting in a gross gain of 30.7%.

Those who started this same process 2 years ago invested a total of R$ 5,400 over the period, obtaining gross profitability of 118%, that is, more than doubled its contribution.