It is important to have a diversified portfolio in order to minimize risk.

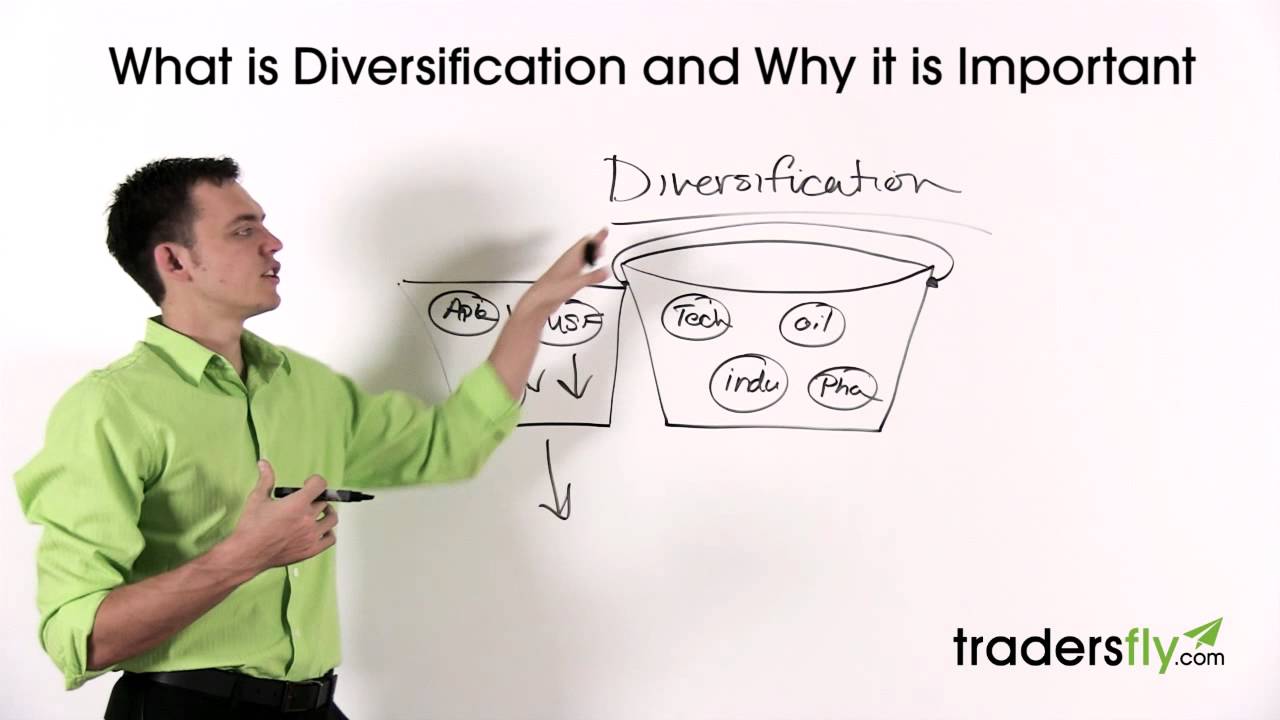

What is Diversification?

-A variety in your pool (a mix of companies, e.g. tech, oil, industrial, pharmaceutical)

-You want to have a mix of industries so that if one industry has a bad year, the rest of your investments still have the potential to do very well

-If you invest everything in one industry and it does poorly, you’ll lose money in all of your investments

-Example: If all of your stock in technology companies (Apple, Google, Microsoft) and technology takes a big hit, all of your stocks go down.

-You are taking a larger risk if you confine yourself to one industry.

-Keeping your portfolio diversified is especially important if you are new to the stock market.

★ SUBSCRIBE TO MY YOUTUBE: ★

http://bit.ly/addtradersfly

★ ABOUT TRADERSFLY ★

TradersFly is a place where I enjoy sharing my knowledge and experience about the stock market, trading, and investing.

Stock trading can be a brutal industry especially if you are new. Watch my free educational training videos to avoid making large mistakes and to just continue to get better.

Stock trading and investing is a long journey – it doesn’t happen overnight. If you are interested to share some insight or contribute to the community we’d love to have you subscribe and join us!

STOCK TRADING COURSES:

— http://tradersfly.com/courses/

STOCK TRADING BOOKS:

— http://tradersfly.com/books/

WEBSITES:

— http://rise2learn.com

— http://criticalcharts.com

— http://investinghelpdesk.com

— http://tradersfly.com

— http://backstageincome.com

— http://sashaevdakov.com

SOCIAL MEDIA:

— http://twitter.com/criticalcharts/

— http://facebook.com/criticalcharts/

MY YOUTUBE CHANNELS:

— TradersFly: http://bit.ly/tradersfly

— BackstageIncome: http://bit.ly/backstageincome

source

Wow

Good, Good!

I am planning on investing in the food chain.. I am thinking things like tyson, monsanto, deere, ect basically all stages of the food system. Would you say this is not diversified enough?

what are your thoughts about a younger person (with high risk tolerance), placing his/her money into one very big company that they expect to do very well over the long term (say Facebook as an example) , , expecting to hold it for ten years, and then riding it out for the long term (but with stop a loss in place for security measure). 2 years later, they may decide to pool another very large sum of their money into another stock, and do the same technique. the person expects to make larger gains, and has security measure of stop loss in place.

great video 🙂