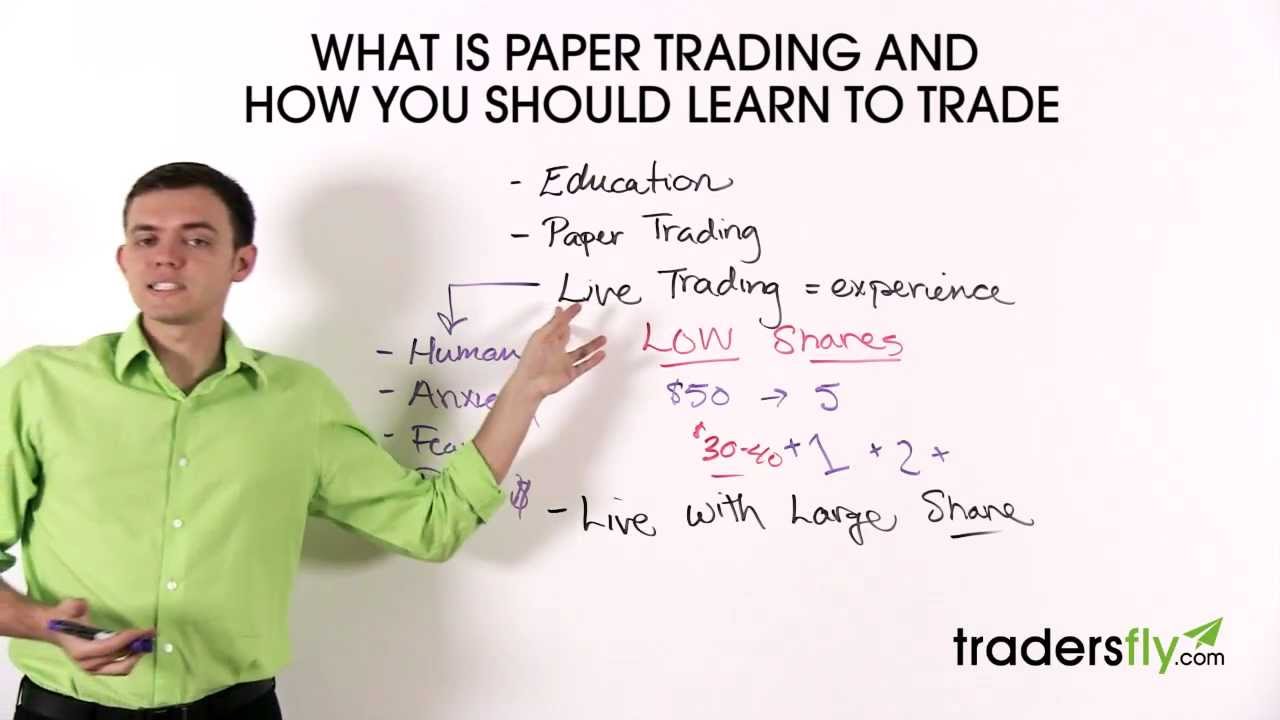

Education, paper trading and live trading with low shares should be used together to acheive success in the stock market.

What is Paper Trading?

-Trading stocks with a fake account or with fake money

-A way to practice before doing live trading

How to Train:

-Get as much education as possible

-Begin paper trading

-Do live trading on low shares in order to gain experience (if you have a stock worth $50/share, don’t trade more than 5 shares

-Example: as the stock market goes up, add 1 share (this will cost you commissions, but you will gain experience), and continue adding one share at a time as it goes up.

-Commissions can cost from $5-$40 per trade. You will be losing money. This business requires your time and money in order to gain education.

-Put these numbers into an excel spreadsheet and multiply them based on the number of shares you want to trade in the future. See if you’re making a healthy profit.

-If you’re consistently successful and you’re trading properly, then begin live trading with larger shares.

Why Live Trading With Low Shares is Essential

-The problem with paper trading is the trade executions will fill automatically, but they might not in live trading: stocks might be more scarce, trade timing might be off, etc.

-Your mindset is changed in live trading (anxiety, fear, you’re using real money, etc)

-Many people are successful with paper trading, but not with live trading initially

-If you go right from paper trading to live trading with larger shares, you’re likely to lose a lot of money

★ SUBSCRIBE TO MY YOUTUBE: ★

http://bit.ly/addtradersfly

★ ABOUT TRADERSFLY ★

TradersFly is a place where I enjoy sharing my knowledge and experience about the stock market, trading, and investing.

Stock trading can be a brutal industry especially if you are new. Watch my free educational training videos to avoid making large mistakes and to just continue to get better.

Stock trading and investing is a long journey – it doesn’t happen overnight. If you are interested to share some insight or contribute to the community we’d love to have you subscribe and join us!

STOCK TRADING COURSES:

— http://tradersfly.com/courses/

STOCK TRADING BOOKS:

— http://tradersfly.com/books/

WEBSITES:

— http://rise2learn.com

— http://criticalcharts.com

— http://investinghelpdesk.com

— http://tradersfly.com

— http://backstageincome.com

— http://sashaevdakov.com

SOCIAL MEDIA:

— http://twitter.com/criticalcharts/

— http://facebook.com/criticalcharts/

MY YOUTUBE CHANNELS:

— TradersFly: http://bit.ly/tradersfly

— BackstageIncome: http://bit.ly/backstageincome

source

My attitude towards transferring from paper trading to real money is the same as entering a trade

SCALE into it, trade smaller size and smaller regularity. Continue to paper trade and add more real money trades until you are use to the added pressure of real money trading.

Do not go straight from solely paper trading to solely real money trading.

any other good tips for transferring to real money trading??

oops….my first trade was 100 share of tesla stock, 3 weeks later i had a $2200 profit… ahhahhahaha

When placing a market order, the simulator can automatically match me with a historical limit order. However, when placing a limit order, the simulator has the task of generating fake interest and a fake buyer.

Is it then logical to conclude that paper trading with market orders is a more realistic experience than paper trading with limit orders?

Good stuff Sasha. Thanks for all the information you are putting out there.

Thank you Sasha for honest and easy instructions for something so serious for all of us.

I can see myself earning and not killing myself with self doubt. Thank You. 🙂

what is 10k 10q form sir what If u got that hand book?

tradingview is paper trading?

Hi, thinkorswim is not available for U.K. Residents, do you know of a good broker available to U.K Residents with paper trading available? I have tried many searches but don't trust if the recommendations are being promoted by affiliates.

sir ..please make some video about the topic of great depression that happened in America during 1929.

What's a good app or website to start paper trading?

what is a good app to paper trade?

your videos are amazing but I'm still trying to figure out about prices on the shares once you buy shares (example you buy them at 30.50) and they go up and you buy more shares at what prices would you be buying the shares? at the original price or current price

Loving all the great content! I have a very broad question, not really seeking an answer more so just tips. With so many options between the various industries and companies, how do you go about "filtering" through the less significant options, and finding the "winners"? Of course consistent research will help but are there any tips you have for what stocks i should really focus on and which i should avoid? Thanks in advance and keep up the great work!

The best videos on the subject of trading are yours! I wish I'd found your site 15 years ago :)) you probably just started then! hope it's not too late @55

You should try explaining what everything is in case there are some very inexperienced beginners like myself. I find it hard to find videos that teach how to get started in stocks at its very core.

Thanks for videos! It is really easy to follow you.

One question related to the "live trading" with one or two stocks. What about brokers which charge per stock price? Is it a real option to be able to train more or they have other limitations like minimal amount of stocks to trade?

Great videos I been watching all of them really informal

I appreciate this video. I always wondered the difference between paper and real trading.

your help would really mean a lot to me thanks.

Hey Sasha I'm really new to this is there a website for paper trading or how does the work?

Can someone send me a link of a training paper trading website ? Couldn't find one to play with fake money ! Thanks

Thanks Sasha, the best advise I've ever received.

I originally disagreed with the advice of starting with minimal orders. But after thinking about it I thought you are so good for telling us that. Bravo!

Awesome advice 🙂

Hi Sasha! I enjoy your videos 🙂 I find it interesting that you said to load up more shares as the stock goes up (I tend to shave off shares to secure some profit). Is there a video that explains this strategy? I know it has to do with not buying all of the shares upfront.

Thank you, Sasha. Your videos are very simple to understand and yet provide great amount of details to beginners like me.. I'm from India and most of your videos hold good for Indian stock markets, as well. Please continue with your great work of enlightening others with your knowledge 🙂

Sasha, Do we really need the trade platforms that offered by the online brokers like they provide us candlestick charts and all that stuff. Is there any way that I can avoid using their tools because the fees are so expensive. Can I just take the charts that were on Yahoo Finance ,Google,etc.. Are they the same charts that provided by the online brokers?

Sasha, great video~

Any suggestions on where I can go for step 1, education?

Some brokerages let you trade certain securities, such as their own ETFs, commission-free.

Excellent video! Very good!

Just started getting into penny stocks, but im reading peter leeds (invest in penny stocks) and he says practice with paper trading stocks like crazy. How much should I start with (real money) once I finish paper stock practice? Im a broke college student but i saved some for learning to invest 😀 thank you for the vid!

Great video as always Sasha 🙂

When you are ready to open a real money brokerage account http://www.scottrade.com is a good online brokerage account that you might want to look at opening.

Very helpful!

Thank you, Mr. Evdakov. I hate this subject but am forcing myself to learn, and you are an excellent teacher.

hey sasha evdaks. i am totally new to stock and everything about it, but i have a question, can people really get rich off of thi

investopedia/simulator

is great website for paper trading

what paper trading software should i start with? will it have real time stock trading?

Great videos Sasha!

All of us over at Anyone Can Teach love the content you are providing to the education community, keep up the great work!